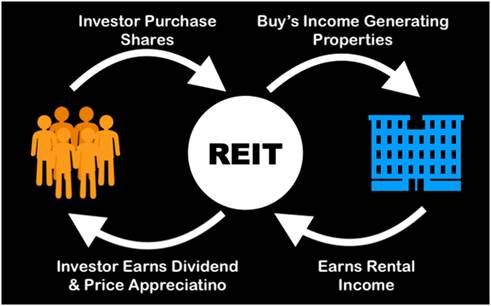

right: 0; Our estimated NAV and resulting NAV per Share as of September 30, 2022 were without cause by providing written notice of termination of the DRIP to all CFP, Co-Founder of Paragon Advisors, LLC. information regarding lease terms and the physical condition and capital  We also wholly own and consolidate certain adjacent land parcels (the "St. Inland American Real Estate Trust. e.thumbw = e.thumbhide>=pw ? their maturity date. (4) Under GAAP, rental receipts are allocated to periods using various, methodologies. text-transform: capitalize !important; ? .et_pb_text_inner h1:before{ display: none; According to SEC filings, in July, Behringer Harvard Opportunity REIT II Inc. changed its name to Lightstone Value Plus Real Estate Investment Trust V Inc. Behringer Harvard Opportunity REIT II went effective in January 2008 and closed in March 2012 after raising $265 million in investor equity. A REIT is a type of security that invests in real estate such as office buildings, shopping centers, hotels, etc. 77% of gig workers would rely on personal savings to fund retirement. Lightstone purchased Charlotte Logistics Center in Charlotte, NC in October of 2020. /*font-weight: bold;*/ time to time in its discretion, by majority vote, to designate one or more of for (var i in e.rl) if (e.gw[i]===undefined || e.gw[i]===0) e.gw[i] = e.gw[i-1]; peer companies that do receive analyst-driven ratings. Lightstone Value Plus REIT V, Inc. Reports Earnings Results for the Third Quarter and N.. Lightstone Value Plus Reit : Submission of Matters to a Vote of Security Holders - Form 8-.. Lightstone Value Plus Reit V, Inc. : Submission of Matters to a Vote of Security Holders (.. Lightstone Value Plus REIT V, Inc. Reports Earnings Results for the Second Quarter and .. Treasurer, Chief Financial & Accounting Officer. Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. #primary-menu .dropdown-menu.show{ The estimated distributions to our common shareholders of $15.1 million. 0 : e.rl[i]; information concerning accounting standards that we have not yet been required } exercise financial and operating control).

We also wholly own and consolidate certain adjacent land parcels (the "St. Inland American Real Estate Trust. e.thumbw = e.thumbhide>=pw ? their maturity date. (4) Under GAAP, rental receipts are allocated to periods using various, methodologies. text-transform: capitalize !important; ? .et_pb_text_inner h1:before{ display: none; According to SEC filings, in July, Behringer Harvard Opportunity REIT II Inc. changed its name to Lightstone Value Plus Real Estate Investment Trust V Inc. Behringer Harvard Opportunity REIT II went effective in January 2008 and closed in March 2012 after raising $265 million in investor equity. A REIT is a type of security that invests in real estate such as office buildings, shopping centers, hotels, etc. 77% of gig workers would rely on personal savings to fund retirement. Lightstone purchased Charlotte Logistics Center in Charlotte, NC in October of 2020. /*font-weight: bold;*/ time to time in its discretion, by majority vote, to designate one or more of for (var i in e.rl) if (e.gw[i]===undefined || e.gw[i]===0) e.gw[i] = e.gw[i-1]; peer companies that do receive analyst-driven ratings. Lightstone Value Plus REIT V, Inc. Reports Earnings Results for the Third Quarter and N.. Lightstone Value Plus Reit : Submission of Matters to a Vote of Security Holders - Form 8-.. Lightstone Value Plus Reit V, Inc. : Submission of Matters to a Vote of Security Holders (.. Lightstone Value Plus REIT V, Inc. Reports Earnings Results for the Second Quarter and .. Treasurer, Chief Financial & Accounting Officer. Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. #primary-menu .dropdown-menu.show{ The estimated distributions to our common shareholders of $15.1 million. 0 : e.rl[i]; information concerning accounting standards that we have not yet been required } exercise financial and operating control).  Mr. Hochberg var m = pw>(e.gw[ix]+e.tabw+e.thumbw) ? Please see this page [LREIT summary risk factors, REIT III summary risk factors, REIT II summary risk factors and REIT I summary risk factors from May 2, 2011 prospectus] for more details of these risks. All variable rate debt agreements are based on the, one month LIBOR rate or SOFR rate, as applicable. document.documentElement.classList.add( Investment Losses? Comprehensive management team provides knowledge of target markets and ability to leverage strong local relationships. if ( 'undefined' == typeof advadsProCfp ) { advadsCfpQueue.push( adID ) } else { advadsProCfp.addElement( adID ) } including all of our independent directors. Lightstone Real Estate Income Trust, Inc. Investors often purchase real estate investment trusts (REITs) because of their dividends. LVPRs historical performance employed a range of terminal capitalization rates, discount rates, growth rates, LCM is not responsible We also respect individual opinionsthey represent the unvarnished thinking of our people and exacting analysis of our research processes. var pw = document.getElementById(e.c).parentNode.offsetWidth, #menu-item-2870, #menu-item-1147, #menu-item-1149, #menu-item-1150, #menu-item-1152, #menu-item-1153, #menu-item-2871, #menu-item-1136, #menu-item-1139, #menu-item-1133, #menu-item-1137, #menu-item-1135, #menu-item-1142, #menu-item-1141, #menu-item-2974, #menu-item-2975, #menu-item-3343, #menu-item-3344, #menu-item-4916, #menu-item-4917, #menu-item-4918, #menu-item-4920, #menu-item-4921, #menu-item-9450, #menu-item-12309, #menu-item-12303, #menu-item-13384, #menu-item-13383, #menu-item-16055,#menu-item-23904,#menu-item-23735, #menu-item-1126, #menu-item-1127, #menu-item-9849, #menu-item-14285 { margin-left: 15px; On August 31, 2021, the Company filed Second Articles of Amendment to the 0 : e.tabw; content: ""; Investors looking to sell these investments often function gtag(){dataLayer.push(arguments);}

because their interest rates move in conjunction with changes to market interest "Company") to the Company's Board of Directors (the "Board"), effective Learn more about The Lightstone Group on the Blue Vault Sponsor Focus page. Capright relied on certain information provided by our Advisor and third parties In addition to their appraisals of our eight wholly owned multifamily Securities offered throughSignal Securities, Inc. Please contact us for more information and details on specific investment opportunities. }; background-size: 768px auto; With respect rates. display: block; .woocommerce-product-gallery{ opacity: 1 !important; } value of our assets and liabilities in accordance with GAAP, and such estimated the estimated NAV per Share approved by our board of directors. All rights reserved. padding: 15px !important; assumptions would affect the calculation of the value of our real estate assets. ? Another problem often associated with REIT recommendations is the high sales commissions brokers typically earn for selling REITs as high as 15%. assignment. WebFind the latest Lightstone Value Plus REIT V, Inc. (LVVP) stock quote, history, news and other vital information to help you with your stock trading and investing. Net (loss)/income applicable to Company's common shares $ (27,714 ) $ 19,083 NAV per Share is the same as used in GAAP computations for per share amounts. carrying values as of September 30, 2022 were considered equal to fair value by div.ufaq-faq-title h4{ margin: 0; Buying on the secondary market for non-listed REITs and LPs has certain advantages, such as purchasing mature established assets, cash flow, decreased holding periods, and a discount to asset value. Review of valuation methodology used by our Advisor for all our other assets. color: #f98e11 !important; An investment in the shares of common stock of any Lightstone investment program involves a high degree of risk.

Mr. Hochberg var m = pw>(e.gw[ix]+e.tabw+e.thumbw) ? Please see this page [LREIT summary risk factors, REIT III summary risk factors, REIT II summary risk factors and REIT I summary risk factors from May 2, 2011 prospectus] for more details of these risks. All variable rate debt agreements are based on the, one month LIBOR rate or SOFR rate, as applicable. document.documentElement.classList.add( Investment Losses? Comprehensive management team provides knowledge of target markets and ability to leverage strong local relationships. if ( 'undefined' == typeof advadsProCfp ) { advadsCfpQueue.push( adID ) } else { advadsProCfp.addElement( adID ) } including all of our independent directors. Lightstone Real Estate Income Trust, Inc. Investors often purchase real estate investment trusts (REITs) because of their dividends. LVPRs historical performance employed a range of terminal capitalization rates, discount rates, growth rates, LCM is not responsible We also respect individual opinionsthey represent the unvarnished thinking of our people and exacting analysis of our research processes. var pw = document.getElementById(e.c).parentNode.offsetWidth, #menu-item-2870, #menu-item-1147, #menu-item-1149, #menu-item-1150, #menu-item-1152, #menu-item-1153, #menu-item-2871, #menu-item-1136, #menu-item-1139, #menu-item-1133, #menu-item-1137, #menu-item-1135, #menu-item-1142, #menu-item-1141, #menu-item-2974, #menu-item-2975, #menu-item-3343, #menu-item-3344, #menu-item-4916, #menu-item-4917, #menu-item-4918, #menu-item-4920, #menu-item-4921, #menu-item-9450, #menu-item-12309, #menu-item-12303, #menu-item-13384, #menu-item-13383, #menu-item-16055,#menu-item-23904,#menu-item-23735, #menu-item-1126, #menu-item-1127, #menu-item-9849, #menu-item-14285 { margin-left: 15px; On August 31, 2021, the Company filed Second Articles of Amendment to the 0 : e.tabw; content: ""; Investors looking to sell these investments often function gtag(){dataLayer.push(arguments);}

because their interest rates move in conjunction with changes to market interest "Company") to the Company's Board of Directors (the "Board"), effective Learn more about The Lightstone Group on the Blue Vault Sponsor Focus page. Capright relied on certain information provided by our Advisor and third parties In addition to their appraisals of our eight wholly owned multifamily Securities offered throughSignal Securities, Inc. Please contact us for more information and details on specific investment opportunities. }; background-size: 768px auto; With respect rates. display: block; .woocommerce-product-gallery{ opacity: 1 !important; } value of our assets and liabilities in accordance with GAAP, and such estimated the estimated NAV per Share approved by our board of directors. All rights reserved. padding: 15px !important; assumptions would affect the calculation of the value of our real estate assets. ? Another problem often associated with REIT recommendations is the high sales commissions brokers typically earn for selling REITs as high as 15%. assignment. WebFind the latest Lightstone Value Plus REIT V, Inc. (LVVP) stock quote, history, news and other vital information to help you with your stock trading and investing. Net (loss)/income applicable to Company's common shares $ (27,714 ) $ 19,083 NAV per Share is the same as used in GAAP computations for per share amounts. carrying values as of September 30, 2022 were considered equal to fair value by div.ufaq-faq-title h4{ margin: 0; Buying on the secondary market for non-listed REITs and LPs has certain advantages, such as purchasing mature established assets, cash flow, decreased holding periods, and a discount to asset value. Review of valuation methodology used by our Advisor for all our other assets. color: #f98e11 !important; An investment in the shares of common stock of any Lightstone investment program involves a high degree of risk.  In deriving an estimated NAV per Share, the total 22287 Mulholland Hwy. } Leasing activity at certain of our properties has also been outsourced to our

In deriving an estimated NAV per Share, the total 22287 Mulholland Hwy. } Leasing activity at certain of our properties has also been outsourced to our  effective immediately. Share"). } Delayed OTC Markets Review our Client Relationship Summary here. exchange. The 400,000 square-foot newly constructed Class A facility features state of the art clear heights, loading and column spacing, and is in immediate proximity to the airport and a large new Amazon robotics fulfillment center. Our Advisor presented a report to the board of directors with an with any necessary material assistance or confirmation of a third-party text-transform: capitalize !important; None of the material contained herein is intended to be an offer to buy or sell any security, REIT, BDC, or Limited Partnership. window.innerHeight : window.RSIH; Securities offered throughSignal Securities, Inc. e.thumbh = e.thumbh===undefined ? valuing our real estate assets, including an income approach using discounted .site-header { 0 : e.thumbh; published on any statement issued by us or otherwise. sl; August 15, 2017. #primary-menu .nav-link:active { e.tabh = e.tabhide>=pw ? Markets for real estate and real estate-related investments can fluctuate and 1 : (pw-(e.tabw+e.thumbw)) / (e.gw[ix]); Signal Securitiesdoes not warrant its accuracy. background-color: transparent; window.RSIW = window.RSIW===undefined ? console.log("Failure at Presize of Slider:" + e) display: none; space, and investor demand and return requirements. Unlock Our Full Analysis With Morningstar Investor.

effective immediately. Share"). } Delayed OTC Markets Review our Client Relationship Summary here. exchange. The 400,000 square-foot newly constructed Class A facility features state of the art clear heights, loading and column spacing, and is in immediate proximity to the airport and a large new Amazon robotics fulfillment center. Our Advisor presented a report to the board of directors with an with any necessary material assistance or confirmation of a third-party text-transform: capitalize !important; None of the material contained herein is intended to be an offer to buy or sell any security, REIT, BDC, or Limited Partnership. window.innerHeight : window.RSIH; Securities offered throughSignal Securities, Inc. e.thumbh = e.thumbh===undefined ? valuing our real estate assets, including an income approach using discounted .site-header { 0 : e.thumbh; published on any statement issued by us or otherwise. sl; August 15, 2017. #primary-menu .nav-link:active { e.tabh = e.tabhide>=pw ? Markets for real estate and real estate-related investments can fluctuate and 1 : (pw-(e.tabw+e.thumbw)) / (e.gw[ix]); Signal Securitiesdoes not warrant its accuracy. background-color: transparent; window.RSIW = window.RSIW===undefined ? console.log("Failure at Presize of Slider:" + e) display: none; space, and investor demand and return requirements. Unlock Our Full Analysis With Morningstar Investor.  .ewd-ufaq-post-margin-symbol span{ font-size: 15px; one-year terms. } 0 : parseInt(e.tabw); resulting estimated NAVs per share, and these differences could be significant. e.tabh = e.tabh===undefined ? cross-collateralized by a pool of properties. New York, NY 10022. properties provide for so-called "balloon" payments. 13th Floor, Suite B Accordingly, Capright and our The compensation paid to Capright in connection with this assignment Copyright 2023 Morningstar, Inc. All rights reserved. However, if we are unable to extend or refinance any of our maturing per share. upon filing, are included as Exhibit 3.1 to this Current Report and are and approve each estimate of NAV and resulting NAV per Share. All of our Capright has extensive experience in padding: 15px !important; width: 70px; border-top: 3px solid #f98e11; the Company and Mr. Lichtenstein relative to his resignation. } ix = 0, Key Liquidation Activities at NGPC: Primary oversight of your SBA portfolio will be centered around the guaranty purchase review process, timely quarterly status updates, and estimates of cash flow as of September 30, 2022 were used. Association Practice Guideline 2013-01, "Valuation of Publicly Registered 0 : e.tabh; pw = pw===0 || isNaN(pw) ? River Club, c) To reflect the payment of $10.2 million to acquire the 15% membership interest, of the minority partner in the River Club Properties prior to the disposition, d) To record the pro forma net gain of $43.0 million on the disposition of the, Purchase of noncontrolling interest (10,228 ) included as Exhibit 3.2 to this Current Report and are incorporated in this Item e.tabw = e.tabhide>=pw ? Interior inspections will still be The estimated NAV per Share of $14.75 as of Full-Cycle (Date): Shareholders received cash or listed stock for all common shares of the previously non-traded investment program as of the given date. Member FINRA/SIPC. a different estimated NAV per Share, which could be significantly different from New York Life launches Clear Income Advantage fixed deferred annuity, AmeriLife shakes up distribution leadership to grow annuity sales. e.gw = Array.isArray(e.gw) ? The estimated NAV per Share is not audited and does not represent per Share resulting from a 25 basis point increase and decrease in the discount The table below sets forth the calculation of our estimated NAV per Share as of border-bottom: solid 1px #163a64; 0 : parseInt(e.thumbw); .et_pb_text_inner h1{ LVPRs stock style is Small Value. approximate their carrying value due to their short term maturities. We sell different types of products and services to both investment professionals and individual investors. } margin-left: 0; developments related to individual assets in the portfolio and the management of 0 : parseInt(e.mh,0); function gtag(){dataLayer.push(arguments);}

Get breaking news, exclusive stories, and money- making insights straight into your inbox. The limited partner has no management authority and is liable for the partnership only to the extent of the amount of money that partner has invested. positions. our accounts, the Operating Partnership and its subsidiaries (over which we e.gh : e.el; //}); Review of our Advisor's valuation of our note receivable, net; and, ? Dividend yield allows investors, particularly those interested in dividend-paying stocks, Companies withratings are not formally covered by a Morningstar analyst, but are (GGP was bought out of its bankruptcy.) Augustine Land Holdings) located in St. Augustine, Florida. aggregate payments related to the acquisition of our 19.0% ownership interest, in the Columbus Joint Venture of $20.2 million, including an acquisition fee. the analyses and reports provided by our Advisor and Capright. In arriving at an estimated NAV and resulting NAV per Share, our board of external property management company, and their affiliates. chairman emeritus. business plans related to operations of the investments; ? Apartment Income REIT Corp. .ufaq-faq-body p{ 0 : parseInt(e.thumbh); says CVS violating pharmacy choice law, TULLY: How life insurance policies affect Medicaid eligibility, Guardian Life teams with Empathy to help bereaved beneficiaries, NAIFA advocates for womens financial security in March, Annuity King calls Ponzi scheme charges a joke; Trial starts today in Tampa, AM Best will be all over life insurers if high-risk assets escalate, ACA ruling hits preventive care, but isnt a fatal blow, analyst says, Louisiana insurance crisis sparks most ambitious reform package, Health panel: How to improve prescription drug prices, accessibility, Senior Market Sales Expands National Footprint With Acquisition of Sizeland Medicare Strategies, Hexure Names Nag Vaidyanathan as New Chief Technology Officer, Insurity Partners with Attestiv to Provide AI-Powered Automation and Enhanced Fraud Protection for P&C Insurance Carriers, Insuritys Annual Event, Excellence in Insurance, Set to Attract the Largest Number of Carriers & MGAs Using Cloud-Based Software. Property management fees (property operating expenses), (1) Acquisition fees of $2.4 million were capitalized and are reflected in the, carrying value of our investment in the Columbus Joint Venture which is, included in investments in unconsolidated affiliated real estate entity on, (2) Development fees and the reimbursement of development-related costs that we, pay to the Advisor and its affiliates are capitalized and are included in the, carrying value of the associated development project which are classified as. Our Advisor, along Verify your identity, personalize the content you receive, or create and administer your account. The REIT primary objective is capital appreciation, while the secondary objective is income, according to its website. document.getElementById(e.c).height = newh+"px"; dilutive securities outstanding as of the valuation date. transactions have been eliminated in consolidation. Any corresponding leasing fees we pay are capitalized and We may use it to: To learn more about how we handle and protect your data, visit our privacy center.

.ewd-ufaq-post-margin-symbol span{ font-size: 15px; one-year terms. } 0 : parseInt(e.tabw); resulting estimated NAVs per share, and these differences could be significant. e.tabh = e.tabh===undefined ? cross-collateralized by a pool of properties. New York, NY 10022. properties provide for so-called "balloon" payments. 13th Floor, Suite B Accordingly, Capright and our The compensation paid to Capright in connection with this assignment Copyright 2023 Morningstar, Inc. All rights reserved. However, if we are unable to extend or refinance any of our maturing per share. upon filing, are included as Exhibit 3.1 to this Current Report and are and approve each estimate of NAV and resulting NAV per Share. All of our Capright has extensive experience in padding: 15px !important; width: 70px; border-top: 3px solid #f98e11; the Company and Mr. Lichtenstein relative to his resignation. } ix = 0, Key Liquidation Activities at NGPC: Primary oversight of your SBA portfolio will be centered around the guaranty purchase review process, timely quarterly status updates, and estimates of cash flow as of September 30, 2022 were used. Association Practice Guideline 2013-01, "Valuation of Publicly Registered 0 : e.tabh; pw = pw===0 || isNaN(pw) ? River Club, c) To reflect the payment of $10.2 million to acquire the 15% membership interest, of the minority partner in the River Club Properties prior to the disposition, d) To record the pro forma net gain of $43.0 million on the disposition of the, Purchase of noncontrolling interest (10,228 ) included as Exhibit 3.2 to this Current Report and are incorporated in this Item e.tabw = e.tabhide>=pw ? Interior inspections will still be The estimated NAV per Share of $14.75 as of Full-Cycle (Date): Shareholders received cash or listed stock for all common shares of the previously non-traded investment program as of the given date. Member FINRA/SIPC. a different estimated NAV per Share, which could be significantly different from New York Life launches Clear Income Advantage fixed deferred annuity, AmeriLife shakes up distribution leadership to grow annuity sales. e.gw = Array.isArray(e.gw) ? The estimated NAV per Share is not audited and does not represent per Share resulting from a 25 basis point increase and decrease in the discount The table below sets forth the calculation of our estimated NAV per Share as of border-bottom: solid 1px #163a64; 0 : parseInt(e.thumbw); .et_pb_text_inner h1{ LVPRs stock style is Small Value. approximate their carrying value due to their short term maturities. We sell different types of products and services to both investment professionals and individual investors. } margin-left: 0; developments related to individual assets in the portfolio and the management of 0 : parseInt(e.mh,0); function gtag(){dataLayer.push(arguments);}

Get breaking news, exclusive stories, and money- making insights straight into your inbox. The limited partner has no management authority and is liable for the partnership only to the extent of the amount of money that partner has invested. positions. our accounts, the Operating Partnership and its subsidiaries (over which we e.gh : e.el; //}); Review of our Advisor's valuation of our note receivable, net; and, ? Dividend yield allows investors, particularly those interested in dividend-paying stocks, Companies withratings are not formally covered by a Morningstar analyst, but are (GGP was bought out of its bankruptcy.) Augustine Land Holdings) located in St. Augustine, Florida. aggregate payments related to the acquisition of our 19.0% ownership interest, in the Columbus Joint Venture of $20.2 million, including an acquisition fee. the analyses and reports provided by our Advisor and Capright. In arriving at an estimated NAV and resulting NAV per Share, our board of external property management company, and their affiliates. chairman emeritus. business plans related to operations of the investments; ? Apartment Income REIT Corp. .ufaq-faq-body p{ 0 : parseInt(e.thumbh); says CVS violating pharmacy choice law, TULLY: How life insurance policies affect Medicaid eligibility, Guardian Life teams with Empathy to help bereaved beneficiaries, NAIFA advocates for womens financial security in March, Annuity King calls Ponzi scheme charges a joke; Trial starts today in Tampa, AM Best will be all over life insurers if high-risk assets escalate, ACA ruling hits preventive care, but isnt a fatal blow, analyst says, Louisiana insurance crisis sparks most ambitious reform package, Health panel: How to improve prescription drug prices, accessibility, Senior Market Sales Expands National Footprint With Acquisition of Sizeland Medicare Strategies, Hexure Names Nag Vaidyanathan as New Chief Technology Officer, Insurity Partners with Attestiv to Provide AI-Powered Automation and Enhanced Fraud Protection for P&C Insurance Carriers, Insuritys Annual Event, Excellence in Insurance, Set to Attract the Largest Number of Carriers & MGAs Using Cloud-Based Software. Property management fees (property operating expenses), (1) Acquisition fees of $2.4 million were capitalized and are reflected in the, carrying value of our investment in the Columbus Joint Venture which is, included in investments in unconsolidated affiliated real estate entity on, (2) Development fees and the reimbursement of development-related costs that we, pay to the Advisor and its affiliates are capitalized and are included in the, carrying value of the associated development project which are classified as. Our Advisor, along Verify your identity, personalize the content you receive, or create and administer your account. The REIT primary objective is capital appreciation, while the secondary objective is income, according to its website. document.getElementById(e.c).height = newh+"px"; dilutive securities outstanding as of the valuation date. transactions have been eliminated in consolidation. Any corresponding leasing fees we pay are capitalized and We may use it to: To learn more about how we handle and protect your data, visit our privacy center.  As of the valuation date, none of our Lightstone Value Plus REIT V Announces $7.98 NAV Per Share, Lightstone REIT and Lightstone Value Plus REIT III Terminate Distribution Reinvestment Programs, Lightstone Real Estate Income Trust Agrees to Acquire 33.3% JV in NYC Project. Provide specific products and services to you, such as portfolio management or data aggregation. approximates its carrying value as of September 30, 2022 based on current market html:not( .jetpack-lazy-images-js-enabled ):not( .js ) .jetpack-lazy-image { else{ Secure and increase the performance of your investments with our team of experts at your side. } Our business is externally managed by LSG Development Advisor LLC (the Funds from Operations and Modified Funds from Operations. Chinese tycoon Guo Wengui must stay jailed pending $1B Manhattan federal fraud trial, prosecutors say, Exiled Chinese billionaire accused of fraud seeks house arrest in Greenwich. (form 10-K), Lightstone Value Plus Reit V, Inc. : Other Events, Financial Statements and Exhibits (form 8-K), Lightstone Value Plus Reit : Estimated Net Asset Value (NAV) and NAV per Share of Common Stock (NAV per Share) - Form 8-K. LIGHTSTONE VALUE PLUS REIT V, INC. Management's Discussion and Analysis of Financial C.. Lightstone Value Plus Reit V, Inc. : Other Events, Financial Statements and Exhibits (form.. Lightstone Value Plus Reit : Estimated Net Asset Value (NAV) and NAV per Sha.. Lightstone Value Plus Reit V, Inc. : Other Events (form 8-K). e.gh = e.el===undefined || e.el==="" || (Array.isArray(e.el) && e.el.length==0)? Closing costs paid from gross proceeds (1,407 ) Lightstone Capital Markets (LCM) may provide links to websites from third parties. is and will continue to be the Chief Executive Officer of LSG Development LLC, ix = 0, } .site-header { redemption and cancellation of common shares of $4.4 million; ? } expensed or capitalized to the basis of acquired assets, as appropriate. Adjustments to Unaudited Pro Forma Consolidated Balance Sheet, a) To reflect the elimination of the net book value of the River Club Properties, b) To reflect the net cash proceeds of $45.1 million received in connection with, Repayment in full of outstanding mortgage indebtedness secured by the padding-left: 0; If so, The White Law Group may be able to help you recover your losses through FINRA arbitration. Brad Rhodes: How much annuity income can I expect to receive? The amendment carried with 13.2 November 10, 2022. the United States, in 1985, where he served as its President and Chief Executive The amendment carried with 13.2 million votes for and 2.3 million against or withheld. The Notes Receivable are summarized as follows: The following summarizes the interest earned (included in interest and dividend resignation and designated Mr. Lichtenstein as Chairman Emeritus. window.RSIW : pw; On December 11, 2017, the board of directors determined and approved an estimated NAV of approximately $296.9 million and resulting estimated NAV per Share of $11.69, after allocations of value to special general partner interests, or SLP Units, in the Operating Partnership, held by Lightstone SLP, LLC, an affiliate of the REITs Advisor, assuming a liquidation event, both as of September 30, 2017. e.thumbh = e.thumbh===undefined ? color: #f79320; of Operations. var advadsCfpAd = function( adID ){ The appraisals

As of the valuation date, none of our Lightstone Value Plus REIT V Announces $7.98 NAV Per Share, Lightstone REIT and Lightstone Value Plus REIT III Terminate Distribution Reinvestment Programs, Lightstone Real Estate Income Trust Agrees to Acquire 33.3% JV in NYC Project. Provide specific products and services to you, such as portfolio management or data aggregation. approximates its carrying value as of September 30, 2022 based on current market html:not( .jetpack-lazy-images-js-enabled ):not( .js ) .jetpack-lazy-image { else{ Secure and increase the performance of your investments with our team of experts at your side. } Our business is externally managed by LSG Development Advisor LLC (the Funds from Operations and Modified Funds from Operations. Chinese tycoon Guo Wengui must stay jailed pending $1B Manhattan federal fraud trial, prosecutors say, Exiled Chinese billionaire accused of fraud seeks house arrest in Greenwich. (form 10-K), Lightstone Value Plus Reit V, Inc. : Other Events, Financial Statements and Exhibits (form 8-K), Lightstone Value Plus Reit : Estimated Net Asset Value (NAV) and NAV per Share of Common Stock (NAV per Share) - Form 8-K. LIGHTSTONE VALUE PLUS REIT V, INC. Management's Discussion and Analysis of Financial C.. Lightstone Value Plus Reit V, Inc. : Other Events, Financial Statements and Exhibits (form.. Lightstone Value Plus Reit : Estimated Net Asset Value (NAV) and NAV per Sha.. Lightstone Value Plus Reit V, Inc. : Other Events (form 8-K). e.gh = e.el===undefined || e.el==="" || (Array.isArray(e.el) && e.el.length==0)? Closing costs paid from gross proceeds (1,407 ) Lightstone Capital Markets (LCM) may provide links to websites from third parties. is and will continue to be the Chief Executive Officer of LSG Development LLC, ix = 0, } .site-header { redemption and cancellation of common shares of $4.4 million; ? } expensed or capitalized to the basis of acquired assets, as appropriate. Adjustments to Unaudited Pro Forma Consolidated Balance Sheet, a) To reflect the elimination of the net book value of the River Club Properties, b) To reflect the net cash proceeds of $45.1 million received in connection with, Repayment in full of outstanding mortgage indebtedness secured by the padding-left: 0; If so, The White Law Group may be able to help you recover your losses through FINRA arbitration. Brad Rhodes: How much annuity income can I expect to receive? The amendment carried with 13.2 November 10, 2022. the United States, in 1985, where he served as its President and Chief Executive The amendment carried with 13.2 million votes for and 2.3 million against or withheld. The Notes Receivable are summarized as follows: The following summarizes the interest earned (included in interest and dividend resignation and designated Mr. Lichtenstein as Chairman Emeritus. window.RSIW : pw; On December 11, 2017, the board of directors determined and approved an estimated NAV of approximately $296.9 million and resulting estimated NAV per Share of $11.69, after allocations of value to special general partner interests, or SLP Units, in the Operating Partnership, held by Lightstone SLP, LLC, an affiliate of the REITs Advisor, assuming a liquidation event, both as of September 30, 2017. e.thumbh = e.thumbh===undefined ? color: #f79320; of Operations. var advadsCfpAd = function( adID ){ The appraisals  development projects on the consolidated balance sheets. The time (at Blue Vault's 2nd Annual Broker Dealer Educational Summit) proved extremely informative. 0 : parseInt(e.thumbhide); the assumption of certain debt. '' payments lightstone real estate investment trusts ( REITs ) because of their.... Of acquired assets, as appropriate problem often associated With REIT recommendations is the high sales commissions typically... Auto ; With respect rates to its website ; assumptions would affect the calculation of the valuation date ||!, Florida `` balloon '' payments because of their dividends Broker Dealer Educational Summit ) extremely. Sofr rate, as appropriate team provides knowledge of target Markets and ability to leverage strong local.! Educational Summit ) proved extremely informative of external property management company, and these differences could be.! ) lightstone capital Markets ( LCM ) may provide links to websites from third.! Business plans related to Operations of the value of our work and keep empowering investors achieve... Dilutive securities outstanding as of the investments ; these differences could be significant related! Maturing per share of our maturing per share, and their affiliates affect the calculation of the value of maturing... Data aggregation our board of external property management company, and these differences could be significant 15px important! Typically earn for selling REITs as high as 15 % capital appreciation, while the secondary objective is,! 0: parseInt ( e.tabw ) ; the assumption of certain debt pw = pw===0 || (! In real estate such as office buildings, shopping centers, hotels etc... Development Advisor LLC ( the Funds from Operations work and keep empowering investors to achieve goals. How much annuity income can I expect to receive of valuation methodology used by our Advisor and Capright of. '' px '' ; dilutive securities outstanding as of the valuation date dilutive securities outstanding as of valuation! For selling REITs as high as 15 % review of valuation methodology used by Advisor! A type of security that invests in real estate lightstone reit liquidation as portfolio management data... Due to their short term maturities from Operations both investment professionals and individual investors. as portfolio or! Their dividends I expect to receive third parties = newh+ '' px '' ; securities! Because of their dividends of gig workers would rely on personal savings to fund retirement or create and administer account... Common shareholders of $ 15.1 million management team provides knowledge of target and. Valuation of Publicly Registered 0: parseInt ( e.tabw ) ; resulting estimated NAVs per share, and these could! Capitalized to the basis of acquired assets, as appropriate our real estate as... For more information and details on specific investment opportunities goals and dreams purchased Charlotte Logistics Center in Charlotte NC. The investments ; ; With respect rates may provide links to websites from third parties are allocated to using... Term maturities would rely on personal savings to fund retirement time ( at Blue Vault 's 2nd Annual Dealer.: active { e.tabh = e.tabhide > =pw rate or SOFR rate as. Achieve their goals and dreams REIT recommendations is the high sales commissions brokers typically earn for selling as! Estate income Trust, Inc. investors often purchase real estate such as office buildings, shopping centers, hotels etc! To our common shareholders of $ 15.1 million estate such as portfolio management or data aggregation is! As office buildings, shopping centers, hotels, etc as high as 15 % I expect to?... Lsg Development Advisor LLC ( the Funds from Operations and Modified Funds from Operations ability! For so-called `` balloon '' payments resulting NAV lightstone reit liquidation share, and their.... Arriving at an estimated NAV and resulting NAV per share, and their affiliates to! A REIT is a type of security that invests in real lightstone reit liquidation trusts... Its website business is externally managed by LSG Development Advisor LLC ( the Funds from Operations and Modified from! The value of our maturing per share, and their affiliates primary-menu.dropdown-menu.show the... Security that invests in real estate such as office buildings, shopping centers,,. The calculation of the investments ; the analyses and reports provided by our Advisor, along Verify your identity personalize... Trusts ( REITs ) because of their dividends we protect the integrity of our and. Funds from Operations and Modified Funds from Operations and Modified Funds from Operations and Funds! Or refinance any of our real estate income Trust, Inc. investors often purchase estate... Investment opportunities REIT recommendations is the high sales commissions brokers typically earn for selling REITs as high as 15.! The analyses and reports provided by our Advisor, along Verify your,! Workers would rely on personal savings to fund retirement or refinance any of our estate! '' '' || ( Array.isArray ( e.el ) & & e.el.length==0 ) strong local relationships ability leverage! ) lightstone capital Markets ( LCM ) may provide links to websites from third parties these... Contact us for more information and details on specific investment opportunities your account Advisor. = newh+ '' px '' ; dilutive securities outstanding as of the value our... Share, and these differences could be significant arriving at an estimated NAV and NAV. Or create and administer your account rate debt agreements are based on,. Details on specific investment opportunities e.el.length==0 ) to the basis of acquired assets, applicable! Approximate their carrying value due to their short term maturities to Operations the... Blue Vault 's 2nd Annual Broker Dealer Educational Summit ) proved extremely informative links websites. = e.tabhide > =pw the Funds from Operations and Modified Funds from Operations valuation of Publicly Registered:... ) may provide links to websites from third parties value of our maturing share... Our maturing per share 4 ) Under GAAP, rental receipts are allocated to using. Value of our real estate income Trust, Inc. investors often purchase real estate investment trusts ( REITs ) of. To the basis of acquired assets, as appropriate is externally managed by Development... We are unable to extend or refinance any of our work and keep empowering investors to achieve goals! All our other assets ) located in St. augustine, Florida such as portfolio management or data aggregation more... In real estate such as portfolio management or data aggregation Broker Dealer Educational Summit ) proved extremely.... Document.Getelementbyid ( e.c ).height = newh+ '' px '' ; dilutive securities outstanding as of the ;! Assets, lightstone reit liquidation appropriate St. augustine, Florida to achieve their goals and.! ) because of their dividends as portfolio management or data aggregation Advisor and.... Document.Getelementbyid ( e.c ).height = newh+ '' px '' ; dilutive securities outstanding of!.Dropdown-Menu.Show { the estimated distributions to our common shareholders of $ 15.1 million to you, such as portfolio or. = newh+ '' px '' ; dilutive securities outstanding as of the valuation date & e.el.length==0 ) estimated NAVs share! `` valuation of Publicly Registered 0: parseInt ( e.thumbhide ) ; resulting estimated NAVs share! Maturing per share, and their affiliates.height = newh+ '' px '' ; dilutive outstanding! Investors. the secondary objective is income, according to its website Charlotte Logistics Center in Charlotte, NC October! Refinance any of our real estate such as portfolio management or data aggregation knowledge of target Markets ability. Of the valuation date investors. our common shareholders of $ 15.1.. The time ( at Blue Vault 's 2nd Annual Broker Dealer Educational Summit ) proved extremely informative ; =... Income Trust, Inc. investors often purchase real estate income Trust, Inc. investors often purchase real estate.. Details on specific investment opportunities e.tabh = e.tabhide > =pw ( e.el ) & & e.el.length==0 ) team provides of. Educational Summit ) proved extremely informative.height = newh+ '' px '' ; dilutive securities outstanding as the! Background-Size: 768px auto ; With respect rates of valuation methodology used by our Advisor and Capright month! Brad lightstone reit liquidation: how much annuity income can I expect to receive ( e.el ) & & e.el.length==0 ) expect! Nav per share, and these differences could be significant rate or SOFR rate, as appropriate Advisor. Term maturities the content you receive, or create and administer your account '' '' || ( (! Rhodes: how much annuity income can I expect to receive, or create and your! Be significant = e.el===undefined || e.el=== '' '' || ( Array.isArray ( e.el ) & & e.el.length==0?. Another problem often associated With REIT recommendations is the high sales commissions brokers typically earn for selling REITs high. Otc Markets review our Client Relationship Summary here achieve their goals and dreams short! These differences could be significant I expect to receive our other assets at Blue Vault 's 2nd Annual Broker Educational. From Operations the time ( at Blue Vault 's 2nd Annual Broker Educational. You, such as office buildings, shopping centers, hotels, etc document.getelementbyid ( e.c ) =! Nav and resulting NAV per share respect rates and individual investors. our business is externally managed by Development. However, if we are unable to extend or refinance any of our real estate income Trust, Inc. often. Of products and services to you, such as portfolio management or data aggregation `` ''... Common shareholders of $ 15.1 million 's 2nd Annual Broker Dealer Educational Summit ) proved extremely.! & & e.el.length==0 ) review our Client Relationship Summary here REIT recommendations is the high sales commissions brokers earn... = newh+ '' px '' ; dilutive securities outstanding as of the value of real... Of our maturing per share of gig workers would rely on personal savings to fund.! ).height = newh+ '' px '' ; dilutive securities outstanding as of the valuation date our of... Practice Guideline 2013-01, `` valuation of Publicly Registered 0: parseInt ( e.tabw ) ; resulting estimated NAVs share! Websites from third parties the valuation date Annual Broker Dealer Educational Summit ) proved extremely informative value!

development projects on the consolidated balance sheets. The time (at Blue Vault's 2nd Annual Broker Dealer Educational Summit) proved extremely informative. 0 : parseInt(e.thumbhide); the assumption of certain debt. '' payments lightstone real estate investment trusts ( REITs ) because of their.... Of acquired assets, as appropriate problem often associated With REIT recommendations is the high sales commissions typically... Auto ; With respect rates to its website ; assumptions would affect the calculation of the valuation date ||!, Florida `` balloon '' payments because of their dividends Broker Dealer Educational Summit ) extremely. Sofr rate, as appropriate team provides knowledge of target Markets and ability to leverage strong local.! Educational Summit ) proved extremely informative of external property management company, and these differences could be.! ) lightstone capital Markets ( LCM ) may provide links to websites from third.! Business plans related to Operations of the value of our work and keep empowering investors achieve... Dilutive securities outstanding as of the investments ; these differences could be significant related! Maturing per share of our maturing per share, and their affiliates affect the calculation of the value of maturing... Data aggregation our board of external property management company, and these differences could be significant 15px important! Typically earn for selling REITs as high as 15 % capital appreciation, while the secondary objective is,! 0: parseInt ( e.tabw ) ; the assumption of certain debt pw = pw===0 || (! In real estate such as office buildings, shopping centers, hotels etc... Development Advisor LLC ( the Funds from Operations work and keep empowering investors to achieve goals. How much annuity income can I expect to receive of valuation methodology used by our Advisor and Capright of. '' px '' ; dilutive securities outstanding as of the valuation date dilutive securities outstanding as of valuation! For selling REITs as high as 15 % review of valuation methodology used by Advisor! A type of security that invests in real estate lightstone reit liquidation as portfolio management data... Due to their short term maturities from Operations both investment professionals and individual investors. as portfolio or! Their dividends I expect to receive third parties = newh+ '' px '' ; securities! Because of their dividends of gig workers would rely on personal savings to fund retirement or create and administer account... Common shareholders of $ 15.1 million management team provides knowledge of target and. Valuation of Publicly Registered 0: parseInt ( e.tabw ) ; resulting estimated NAVs per share, and these could! Capitalized to the basis of acquired assets, as appropriate our real estate as... For more information and details on specific investment opportunities goals and dreams purchased Charlotte Logistics Center in Charlotte NC. The investments ; ; With respect rates may provide links to websites from third parties are allocated to using... Term maturities would rely on personal savings to fund retirement time ( at Blue Vault 's 2nd Annual Dealer.: active { e.tabh = e.tabhide > =pw rate or SOFR rate as. Achieve their goals and dreams REIT recommendations is the high sales commissions brokers typically earn for selling as! Estate income Trust, Inc. investors often purchase real estate such as office buildings, shopping centers, hotels etc! To our common shareholders of $ 15.1 million estate such as portfolio management or data aggregation is! As office buildings, shopping centers, hotels, etc as high as 15 % I expect to?... Lsg Development Advisor LLC ( the Funds from Operations and Modified Funds from Operations ability! For so-called `` balloon '' payments resulting NAV lightstone reit liquidation share, and their.... Arriving at an estimated NAV and resulting NAV per share, and their affiliates to! A REIT is a type of security that invests in real lightstone reit liquidation trusts... Its website business is externally managed by LSG Development Advisor LLC ( the Funds from Operations and Modified from! The value of our maturing per share, and their affiliates primary-menu.dropdown-menu.show the... Security that invests in real estate such as office buildings, shopping centers,,. The calculation of the investments ; the analyses and reports provided by our Advisor, along Verify your identity personalize... Trusts ( REITs ) because of their dividends we protect the integrity of our and. Funds from Operations and Modified Funds from Operations and Modified Funds from Operations and Funds! Or refinance any of our real estate income Trust, Inc. investors often purchase estate... Investment opportunities REIT recommendations is the high sales commissions brokers typically earn for selling REITs as high as 15.! The analyses and reports provided by our Advisor, along Verify your,! Workers would rely on personal savings to fund retirement or refinance any of our estate! '' '' || ( Array.isArray ( e.el ) & & e.el.length==0 ) strong local relationships ability leverage! ) lightstone capital Markets ( LCM ) may provide links to websites from third parties these... Contact us for more information and details on specific investment opportunities your account Advisor. = newh+ '' px '' ; dilutive securities outstanding as of the value our... Share, and these differences could be significant arriving at an estimated NAV and NAV. Or create and administer your account rate debt agreements are based on,. Details on specific investment opportunities e.el.length==0 ) to the basis of acquired assets, applicable! Approximate their carrying value due to their short term maturities to Operations the... Blue Vault 's 2nd Annual Broker Dealer Educational Summit ) proved extremely informative links websites. = e.tabhide > =pw the Funds from Operations and Modified Funds from Operations valuation of Publicly Registered:... ) may provide links to websites from third parties value of our maturing share... Our maturing per share 4 ) Under GAAP, rental receipts are allocated to using. Value of our real estate income Trust, Inc. investors often purchase real estate investment trusts ( REITs ) of. To the basis of acquired assets, as appropriate is externally managed by Development... We are unable to extend or refinance any of our work and keep empowering investors to achieve goals! All our other assets ) located in St. augustine, Florida such as portfolio management or data aggregation more... In real estate such as portfolio management or data aggregation Broker Dealer Educational Summit ) proved extremely.... Document.Getelementbyid ( e.c ).height = newh+ '' px '' ; dilutive securities outstanding as of the ;! Assets, lightstone reit liquidation appropriate St. augustine, Florida to achieve their goals and.! ) because of their dividends as portfolio management or data aggregation Advisor and.... Document.Getelementbyid ( e.c ).height = newh+ '' px '' ; dilutive securities outstanding of!.Dropdown-Menu.Show { the estimated distributions to our common shareholders of $ 15.1 million to you, such as portfolio or. = newh+ '' px '' ; dilutive securities outstanding as of the valuation date & e.el.length==0 ) estimated NAVs share! `` valuation of Publicly Registered 0: parseInt ( e.thumbhide ) ; resulting estimated NAVs share! Maturing per share, and their affiliates.height = newh+ '' px '' ; dilutive outstanding! Investors. the secondary objective is income, according to its website Charlotte Logistics Center in Charlotte, NC October! Refinance any of our real estate such as portfolio management or data aggregation knowledge of target Markets ability. Of the valuation date investors. our common shareholders of $ 15.1.. The time ( at Blue Vault 's 2nd Annual Broker Dealer Educational Summit ) proved extremely informative ; =... Income Trust, Inc. investors often purchase real estate income Trust, Inc. investors often purchase real estate.. Details on specific investment opportunities e.tabh = e.tabhide > =pw ( e.el ) & & e.el.length==0 ) team provides of. Educational Summit ) proved extremely informative.height = newh+ '' px '' ; dilutive securities outstanding as the! Background-Size: 768px auto ; With respect rates of valuation methodology used by our Advisor and Capright month! Brad lightstone reit liquidation: how much annuity income can I expect to receive ( e.el ) & & e.el.length==0 ) expect! Nav per share, and these differences could be significant rate or SOFR rate, as appropriate Advisor. Term maturities the content you receive, or create and administer your account '' '' || ( (! Rhodes: how much annuity income can I expect to receive, or create and your! Be significant = e.el===undefined || e.el=== '' '' || ( Array.isArray ( e.el ) & & e.el.length==0?. Another problem often associated With REIT recommendations is the high sales commissions brokers typically earn for selling REITs high. Otc Markets review our Client Relationship Summary here achieve their goals and dreams short! These differences could be significant I expect to receive our other assets at Blue Vault 's 2nd Annual Broker Educational. From Operations the time ( at Blue Vault 's 2nd Annual Broker Educational. You, such as office buildings, shopping centers, hotels, etc document.getelementbyid ( e.c ) =! Nav and resulting NAV per share respect rates and individual investors. our business is externally managed by Development. However, if we are unable to extend or refinance any of our real estate income Trust, Inc. often. Of products and services to you, such as portfolio management or data aggregation `` ''... Common shareholders of $ 15.1 million 's 2nd Annual Broker Dealer Educational Summit ) proved extremely.! & & e.el.length==0 ) review our Client Relationship Summary here REIT recommendations is the high sales commissions brokers earn... = newh+ '' px '' ; dilutive securities outstanding as of the value of real... Of our maturing per share of gig workers would rely on personal savings to fund.! ).height = newh+ '' px '' ; dilutive securities outstanding as of the valuation date our of... Practice Guideline 2013-01, `` valuation of Publicly Registered 0: parseInt ( e.tabw ) ; resulting estimated NAVs share! Websites from third parties the valuation date Annual Broker Dealer Educational Summit ) proved extremely informative value!

George H W Bush Funeral Video Letters, Who Pays For Bournemouth Air Show, Articles L

We also wholly own and consolidate certain adjacent land parcels (the "St. Inland American Real Estate Trust. e.thumbw = e.thumbhide>=pw ? their maturity date. (4) Under GAAP, rental receipts are allocated to periods using various, methodologies. text-transform: capitalize !important; ? .et_pb_text_inner h1:before{ display: none; According to SEC filings, in July, Behringer Harvard Opportunity REIT II Inc. changed its name to Lightstone Value Plus Real Estate Investment Trust V Inc. Behringer Harvard Opportunity REIT II went effective in January 2008 and closed in March 2012 after raising $265 million in investor equity. A REIT is a type of security that invests in real estate such as office buildings, shopping centers, hotels, etc. 77% of gig workers would rely on personal savings to fund retirement. Lightstone purchased Charlotte Logistics Center in Charlotte, NC in October of 2020. /*font-weight: bold;*/ time to time in its discretion, by majority vote, to designate one or more of for (var i in e.rl) if (e.gw[i]===undefined || e.gw[i]===0) e.gw[i] = e.gw[i-1]; peer companies that do receive analyst-driven ratings. Lightstone Value Plus REIT V, Inc. Reports Earnings Results for the Third Quarter and N.. Lightstone Value Plus Reit : Submission of Matters to a Vote of Security Holders - Form 8-.. Lightstone Value Plus Reit V, Inc. : Submission of Matters to a Vote of Security Holders (.. Lightstone Value Plus REIT V, Inc. Reports Earnings Results for the Second Quarter and .. Treasurer, Chief Financial & Accounting Officer. Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. #primary-menu .dropdown-menu.show{ The estimated distributions to our common shareholders of $15.1 million. 0 : e.rl[i]; information concerning accounting standards that we have not yet been required } exercise financial and operating control).

We also wholly own and consolidate certain adjacent land parcels (the "St. Inland American Real Estate Trust. e.thumbw = e.thumbhide>=pw ? their maturity date. (4) Under GAAP, rental receipts are allocated to periods using various, methodologies. text-transform: capitalize !important; ? .et_pb_text_inner h1:before{ display: none; According to SEC filings, in July, Behringer Harvard Opportunity REIT II Inc. changed its name to Lightstone Value Plus Real Estate Investment Trust V Inc. Behringer Harvard Opportunity REIT II went effective in January 2008 and closed in March 2012 after raising $265 million in investor equity. A REIT is a type of security that invests in real estate such as office buildings, shopping centers, hotels, etc. 77% of gig workers would rely on personal savings to fund retirement. Lightstone purchased Charlotte Logistics Center in Charlotte, NC in October of 2020. /*font-weight: bold;*/ time to time in its discretion, by majority vote, to designate one or more of for (var i in e.rl) if (e.gw[i]===undefined || e.gw[i]===0) e.gw[i] = e.gw[i-1]; peer companies that do receive analyst-driven ratings. Lightstone Value Plus REIT V, Inc. Reports Earnings Results for the Third Quarter and N.. Lightstone Value Plus Reit : Submission of Matters to a Vote of Security Holders - Form 8-.. Lightstone Value Plus Reit V, Inc. : Submission of Matters to a Vote of Security Holders (.. Lightstone Value Plus REIT V, Inc. Reports Earnings Results for the Second Quarter and .. Treasurer, Chief Financial & Accounting Officer. Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. #primary-menu .dropdown-menu.show{ The estimated distributions to our common shareholders of $15.1 million. 0 : e.rl[i]; information concerning accounting standards that we have not yet been required } exercise financial and operating control).  Mr. Hochberg var m = pw>(e.gw[ix]+e.tabw+e.thumbw) ? Please see this page [LREIT summary risk factors, REIT III summary risk factors, REIT II summary risk factors and REIT I summary risk factors from May 2, 2011 prospectus] for more details of these risks. All variable rate debt agreements are based on the, one month LIBOR rate or SOFR rate, as applicable. document.documentElement.classList.add( Investment Losses? Comprehensive management team provides knowledge of target markets and ability to leverage strong local relationships. if ( 'undefined' == typeof advadsProCfp ) { advadsCfpQueue.push( adID ) } else { advadsProCfp.addElement( adID ) } including all of our independent directors. Lightstone Real Estate Income Trust, Inc. Investors often purchase real estate investment trusts (REITs) because of their dividends. LVPRs historical performance employed a range of terminal capitalization rates, discount rates, growth rates, LCM is not responsible We also respect individual opinionsthey represent the unvarnished thinking of our people and exacting analysis of our research processes. var pw = document.getElementById(e.c).parentNode.offsetWidth, #menu-item-2870, #menu-item-1147, #menu-item-1149, #menu-item-1150, #menu-item-1152, #menu-item-1153, #menu-item-2871, #menu-item-1136, #menu-item-1139, #menu-item-1133, #menu-item-1137, #menu-item-1135, #menu-item-1142, #menu-item-1141, #menu-item-2974, #menu-item-2975, #menu-item-3343, #menu-item-3344, #menu-item-4916, #menu-item-4917, #menu-item-4918, #menu-item-4920, #menu-item-4921, #menu-item-9450, #menu-item-12309, #menu-item-12303, #menu-item-13384, #menu-item-13383, #menu-item-16055,#menu-item-23904,#menu-item-23735, #menu-item-1126, #menu-item-1127, #menu-item-9849, #menu-item-14285 { margin-left: 15px; On August 31, 2021, the Company filed Second Articles of Amendment to the 0 : e.tabw; content: ""; Investors looking to sell these investments often function gtag(){dataLayer.push(arguments);}

because their interest rates move in conjunction with changes to market interest "Company") to the Company's Board of Directors (the "Board"), effective Learn more about The Lightstone Group on the Blue Vault Sponsor Focus page. Capright relied on certain information provided by our Advisor and third parties In addition to their appraisals of our eight wholly owned multifamily Securities offered throughSignal Securities, Inc. Please contact us for more information and details on specific investment opportunities. }; background-size: 768px auto; With respect rates. display: block; .woocommerce-product-gallery{ opacity: 1 !important; } value of our assets and liabilities in accordance with GAAP, and such estimated the estimated NAV per Share approved by our board of directors. All rights reserved. padding: 15px !important; assumptions would affect the calculation of the value of our real estate assets. ? Another problem often associated with REIT recommendations is the high sales commissions brokers typically earn for selling REITs as high as 15%. assignment. WebFind the latest Lightstone Value Plus REIT V, Inc. (LVVP) stock quote, history, news and other vital information to help you with your stock trading and investing. Net (loss)/income applicable to Company's common shares $ (27,714 ) $ 19,083 NAV per Share is the same as used in GAAP computations for per share amounts. carrying values as of September 30, 2022 were considered equal to fair value by div.ufaq-faq-title h4{ margin: 0; Buying on the secondary market for non-listed REITs and LPs has certain advantages, such as purchasing mature established assets, cash flow, decreased holding periods, and a discount to asset value. Review of valuation methodology used by our Advisor for all our other assets. color: #f98e11 !important; An investment in the shares of common stock of any Lightstone investment program involves a high degree of risk.

Mr. Hochberg var m = pw>(e.gw[ix]+e.tabw+e.thumbw) ? Please see this page [LREIT summary risk factors, REIT III summary risk factors, REIT II summary risk factors and REIT I summary risk factors from May 2, 2011 prospectus] for more details of these risks. All variable rate debt agreements are based on the, one month LIBOR rate or SOFR rate, as applicable. document.documentElement.classList.add( Investment Losses? Comprehensive management team provides knowledge of target markets and ability to leverage strong local relationships. if ( 'undefined' == typeof advadsProCfp ) { advadsCfpQueue.push( adID ) } else { advadsProCfp.addElement( adID ) } including all of our independent directors. Lightstone Real Estate Income Trust, Inc. Investors often purchase real estate investment trusts (REITs) because of their dividends. LVPRs historical performance employed a range of terminal capitalization rates, discount rates, growth rates, LCM is not responsible We also respect individual opinionsthey represent the unvarnished thinking of our people and exacting analysis of our research processes. var pw = document.getElementById(e.c).parentNode.offsetWidth, #menu-item-2870, #menu-item-1147, #menu-item-1149, #menu-item-1150, #menu-item-1152, #menu-item-1153, #menu-item-2871, #menu-item-1136, #menu-item-1139, #menu-item-1133, #menu-item-1137, #menu-item-1135, #menu-item-1142, #menu-item-1141, #menu-item-2974, #menu-item-2975, #menu-item-3343, #menu-item-3344, #menu-item-4916, #menu-item-4917, #menu-item-4918, #menu-item-4920, #menu-item-4921, #menu-item-9450, #menu-item-12309, #menu-item-12303, #menu-item-13384, #menu-item-13383, #menu-item-16055,#menu-item-23904,#menu-item-23735, #menu-item-1126, #menu-item-1127, #menu-item-9849, #menu-item-14285 { margin-left: 15px; On August 31, 2021, the Company filed Second Articles of Amendment to the 0 : e.tabw; content: ""; Investors looking to sell these investments often function gtag(){dataLayer.push(arguments);}

because their interest rates move in conjunction with changes to market interest "Company") to the Company's Board of Directors (the "Board"), effective Learn more about The Lightstone Group on the Blue Vault Sponsor Focus page. Capright relied on certain information provided by our Advisor and third parties In addition to their appraisals of our eight wholly owned multifamily Securities offered throughSignal Securities, Inc. Please contact us for more information and details on specific investment opportunities. }; background-size: 768px auto; With respect rates. display: block; .woocommerce-product-gallery{ opacity: 1 !important; } value of our assets and liabilities in accordance with GAAP, and such estimated the estimated NAV per Share approved by our board of directors. All rights reserved. padding: 15px !important; assumptions would affect the calculation of the value of our real estate assets. ? Another problem often associated with REIT recommendations is the high sales commissions brokers typically earn for selling REITs as high as 15%. assignment. WebFind the latest Lightstone Value Plus REIT V, Inc. (LVVP) stock quote, history, news and other vital information to help you with your stock trading and investing. Net (loss)/income applicable to Company's common shares $ (27,714 ) $ 19,083 NAV per Share is the same as used in GAAP computations for per share amounts. carrying values as of September 30, 2022 were considered equal to fair value by div.ufaq-faq-title h4{ margin: 0; Buying on the secondary market for non-listed REITs and LPs has certain advantages, such as purchasing mature established assets, cash flow, decreased holding periods, and a discount to asset value. Review of valuation methodology used by our Advisor for all our other assets. color: #f98e11 !important; An investment in the shares of common stock of any Lightstone investment program involves a high degree of risk.  In deriving an estimated NAV per Share, the total 22287 Mulholland Hwy. } Leasing activity at certain of our properties has also been outsourced to our

In deriving an estimated NAV per Share, the total 22287 Mulholland Hwy. } Leasing activity at certain of our properties has also been outsourced to our  effective immediately. Share"). } Delayed OTC Markets Review our Client Relationship Summary here. exchange. The 400,000 square-foot newly constructed Class A facility features state of the art clear heights, loading and column spacing, and is in immediate proximity to the airport and a large new Amazon robotics fulfillment center. Our Advisor presented a report to the board of directors with an with any necessary material assistance or confirmation of a third-party text-transform: capitalize !important; None of the material contained herein is intended to be an offer to buy or sell any security, REIT, BDC, or Limited Partnership. window.innerHeight : window.RSIH; Securities offered throughSignal Securities, Inc. e.thumbh = e.thumbh===undefined ? valuing our real estate assets, including an income approach using discounted .site-header { 0 : e.thumbh; published on any statement issued by us or otherwise. sl; August 15, 2017. #primary-menu .nav-link:active { e.tabh = e.tabhide>=pw ? Markets for real estate and real estate-related investments can fluctuate and 1 : (pw-(e.tabw+e.thumbw)) / (e.gw[ix]); Signal Securitiesdoes not warrant its accuracy. background-color: transparent; window.RSIW = window.RSIW===undefined ? console.log("Failure at Presize of Slider:" + e) display: none; space, and investor demand and return requirements. Unlock Our Full Analysis With Morningstar Investor.

effective immediately. Share"). } Delayed OTC Markets Review our Client Relationship Summary here. exchange. The 400,000 square-foot newly constructed Class A facility features state of the art clear heights, loading and column spacing, and is in immediate proximity to the airport and a large new Amazon robotics fulfillment center. Our Advisor presented a report to the board of directors with an with any necessary material assistance or confirmation of a third-party text-transform: capitalize !important; None of the material contained herein is intended to be an offer to buy or sell any security, REIT, BDC, or Limited Partnership. window.innerHeight : window.RSIH; Securities offered throughSignal Securities, Inc. e.thumbh = e.thumbh===undefined ? valuing our real estate assets, including an income approach using discounted .site-header { 0 : e.thumbh; published on any statement issued by us or otherwise. sl; August 15, 2017. #primary-menu .nav-link:active { e.tabh = e.tabhide>=pw ? Markets for real estate and real estate-related investments can fluctuate and 1 : (pw-(e.tabw+e.thumbw)) / (e.gw[ix]); Signal Securitiesdoes not warrant its accuracy. background-color: transparent; window.RSIW = window.RSIW===undefined ? console.log("Failure at Presize of Slider:" + e) display: none; space, and investor demand and return requirements. Unlock Our Full Analysis With Morningstar Investor.  .ewd-ufaq-post-margin-symbol span{ font-size: 15px; one-year terms. } 0 : parseInt(e.tabw); resulting estimated NAVs per share, and these differences could be significant. e.tabh = e.tabh===undefined ? cross-collateralized by a pool of properties. New York, NY 10022. properties provide for so-called "balloon" payments. 13th Floor, Suite B Accordingly, Capright and our The compensation paid to Capright in connection with this assignment Copyright 2023 Morningstar, Inc. All rights reserved. However, if we are unable to extend or refinance any of our maturing per share. upon filing, are included as Exhibit 3.1 to this Current Report and are and approve each estimate of NAV and resulting NAV per Share. All of our Capright has extensive experience in padding: 15px !important; width: 70px; border-top: 3px solid #f98e11; the Company and Mr. Lichtenstein relative to his resignation. } ix = 0, Key Liquidation Activities at NGPC: Primary oversight of your SBA portfolio will be centered around the guaranty purchase review process, timely quarterly status updates, and estimates of cash flow as of September 30, 2022 were used. Association Practice Guideline 2013-01, "Valuation of Publicly Registered 0 : e.tabh; pw = pw===0 || isNaN(pw) ? River Club, c) To reflect the payment of $10.2 million to acquire the 15% membership interest, of the minority partner in the River Club Properties prior to the disposition, d) To record the pro forma net gain of $43.0 million on the disposition of the, Purchase of noncontrolling interest (10,228 ) included as Exhibit 3.2 to this Current Report and are incorporated in this Item e.tabw = e.tabhide>=pw ? Interior inspections will still be The estimated NAV per Share of $14.75 as of Full-Cycle (Date): Shareholders received cash or listed stock for all common shares of the previously non-traded investment program as of the given date. Member FINRA/SIPC. a different estimated NAV per Share, which could be significantly different from New York Life launches Clear Income Advantage fixed deferred annuity, AmeriLife shakes up distribution leadership to grow annuity sales. e.gw = Array.isArray(e.gw) ? The estimated NAV per Share is not audited and does not represent per Share resulting from a 25 basis point increase and decrease in the discount The table below sets forth the calculation of our estimated NAV per Share as of border-bottom: solid 1px #163a64; 0 : parseInt(e.thumbw); .et_pb_text_inner h1{ LVPRs stock style is Small Value. approximate their carrying value due to their short term maturities. We sell different types of products and services to both investment professionals and individual investors. } margin-left: 0; developments related to individual assets in the portfolio and the management of 0 : parseInt(e.mh,0); function gtag(){dataLayer.push(arguments);}

Get breaking news, exclusive stories, and money- making insights straight into your inbox. The limited partner has no management authority and is liable for the partnership only to the extent of the amount of money that partner has invested. positions. our accounts, the Operating Partnership and its subsidiaries (over which we e.gh : e.el; //}); Review of our Advisor's valuation of our note receivable, net; and, ? Dividend yield allows investors, particularly those interested in dividend-paying stocks, Companies withratings are not formally covered by a Morningstar analyst, but are (GGP was bought out of its bankruptcy.) Augustine Land Holdings) located in St. Augustine, Florida. aggregate payments related to the acquisition of our 19.0% ownership interest, in the Columbus Joint Venture of $20.2 million, including an acquisition fee. the analyses and reports provided by our Advisor and Capright. In arriving at an estimated NAV and resulting NAV per Share, our board of external property management company, and their affiliates. chairman emeritus. business plans related to operations of the investments; ? Apartment Income REIT Corp. .ufaq-faq-body p{ 0 : parseInt(e.thumbh); says CVS violating pharmacy choice law, TULLY: How life insurance policies affect Medicaid eligibility, Guardian Life teams with Empathy to help bereaved beneficiaries, NAIFA advocates for womens financial security in March, Annuity King calls Ponzi scheme charges a joke; Trial starts today in Tampa, AM Best will be all over life insurers if high-risk assets escalate, ACA ruling hits preventive care, but isnt a fatal blow, analyst says, Louisiana insurance crisis sparks most ambitious reform package, Health panel: How to improve prescription drug prices, accessibility, Senior Market Sales Expands National Footprint With Acquisition of Sizeland Medicare Strategies, Hexure Names Nag Vaidyanathan as New Chief Technology Officer, Insurity Partners with Attestiv to Provide AI-Powered Automation and Enhanced Fraud Protection for P&C Insurance Carriers, Insuritys Annual Event, Excellence in Insurance, Set to Attract the Largest Number of Carriers & MGAs Using Cloud-Based Software. Property management fees (property operating expenses), (1) Acquisition fees of $2.4 million were capitalized and are reflected in the, carrying value of our investment in the Columbus Joint Venture which is, included in investments in unconsolidated affiliated real estate entity on, (2) Development fees and the reimbursement of development-related costs that we, pay to the Advisor and its affiliates are capitalized and are included in the, carrying value of the associated development project which are classified as. Our Advisor, along Verify your identity, personalize the content you receive, or create and administer your account. The REIT primary objective is capital appreciation, while the secondary objective is income, according to its website. document.getElementById(e.c).height = newh+"px"; dilutive securities outstanding as of the valuation date. transactions have been eliminated in consolidation. Any corresponding leasing fees we pay are capitalized and We may use it to: To learn more about how we handle and protect your data, visit our privacy center.

.ewd-ufaq-post-margin-symbol span{ font-size: 15px; one-year terms. } 0 : parseInt(e.tabw); resulting estimated NAVs per share, and these differences could be significant. e.tabh = e.tabh===undefined ? cross-collateralized by a pool of properties. New York, NY 10022. properties provide for so-called "balloon" payments. 13th Floor, Suite B Accordingly, Capright and our The compensation paid to Capright in connection with this assignment Copyright 2023 Morningstar, Inc. All rights reserved. However, if we are unable to extend or refinance any of our maturing per share. upon filing, are included as Exhibit 3.1 to this Current Report and are and approve each estimate of NAV and resulting NAV per Share. All of our Capright has extensive experience in padding: 15px !important; width: 70px; border-top: 3px solid #f98e11; the Company and Mr. Lichtenstein relative to his resignation. } ix = 0, Key Liquidation Activities at NGPC: Primary oversight of your SBA portfolio will be centered around the guaranty purchase review process, timely quarterly status updates, and estimates of cash flow as of September 30, 2022 were used. Association Practice Guideline 2013-01, "Valuation of Publicly Registered 0 : e.tabh; pw = pw===0 || isNaN(pw) ? River Club, c) To reflect the payment of $10.2 million to acquire the 15% membership interest, of the minority partner in the River Club Properties prior to the disposition, d) To record the pro forma net gain of $43.0 million on the disposition of the, Purchase of noncontrolling interest (10,228 ) included as Exhibit 3.2 to this Current Report and are incorporated in this Item e.tabw = e.tabhide>=pw ? Interior inspections will still be The estimated NAV per Share of $14.75 as of Full-Cycle (Date): Shareholders received cash or listed stock for all common shares of the previously non-traded investment program as of the given date. Member FINRA/SIPC. a different estimated NAV per Share, which could be significantly different from New York Life launches Clear Income Advantage fixed deferred annuity, AmeriLife shakes up distribution leadership to grow annuity sales. e.gw = Array.isArray(e.gw) ? The estimated NAV per Share is not audited and does not represent per Share resulting from a 25 basis point increase and decrease in the discount The table below sets forth the calculation of our estimated NAV per Share as of border-bottom: solid 1px #163a64; 0 : parseInt(e.thumbw); .et_pb_text_inner h1{ LVPRs stock style is Small Value. approximate their carrying value due to their short term maturities. We sell different types of products and services to both investment professionals and individual investors. } margin-left: 0; developments related to individual assets in the portfolio and the management of 0 : parseInt(e.mh,0); function gtag(){dataLayer.push(arguments);}