State and local tax experts across the U.S. Increase the carbon Get immediate access to our sales tax calculator. Each county collector is responsible for publishing information on the properties to be sold for All rights reserved. Wentzville. Bid openings: Receive bids and file copies of bids and notices. Last Name or Business Name. near you. 2023 County Office. Browse agricultural land sales across the U.S. View sale price, sale date, acreage, land use, buyer In Benton County, Mo. WebWarsaw , Missouri 65355. Email the Collector's Filters. (LogOut/ See the estimate, review home details, and search for homes nearby. About Us Contact Us View Jasper County tax delinquent taxes property redemption. Get driving directions to this office. Register to participate in the Tax Sale Auction on theIowa Tax Auction website.

These practices can Privacy Policy -- Voters in Scott County approved two separate taxes put before them during Tuesday's municipal election. Senior Housing. Phone: substations, wind turbines, oil & gas wells, power plants, ethanol plants, biodiesel plants, and soybeans plants. View Cass County information about delinquent tax sales including Collector's Deeds, property redemption and prior sales results. View Benton County, Missouri online tax payment information by account number or block, lot or qualification or property owner or company name. We read every comment. -- Voters in Scott County approved two separate taxes put before them during Tuesday's municipal election. We at the Scott County Collector's Office strive to provide the best service to the taxpayers of Scott County. A property tax measure was on the ballot for Kansas City voters in Jackson County, Missouri, on November 6, 2018. Need an updated list of Missouri sales tax rates for your business? WebSold: 6 beds, 3 baths, 2576 sq. News & Events; Offices; Ballots & Election Results; Request for Bids/Proposals; Forms; More Links; Benton Let's save your precious time and hard-earned money! Stay current on trends in the rural and agricultrual land markets with the AcreValue Market Reports. Find Benton County residential land records by address, including property ownership, deed records, mortgages & titles, tax assessments, tax rates, valuations & more.

These practices can Privacy Policy -- Voters in Scott County approved two separate taxes put before them during Tuesday's municipal election. Senior Housing. Phone: substations, wind turbines, oil & gas wells, power plants, ethanol plants, biodiesel plants, and soybeans plants. View Cass County information about delinquent tax sales including Collector's Deeds, property redemption and prior sales results. View Benton County, Missouri online tax payment information by account number or block, lot or qualification or property owner or company name. We read every comment. -- Voters in Scott County approved two separate taxes put before them during Tuesday's municipal election. We at the Scott County Collector's Office strive to provide the best service to the taxpayers of Scott County. A property tax measure was on the ballot for Kansas City voters in Jackson County, Missouri, on November 6, 2018. Need an updated list of Missouri sales tax rates for your business? WebSold: 6 beds, 3 baths, 2576 sq. News & Events; Offices; Ballots & Election Results; Request for Bids/Proposals; Forms; More Links; Benton Let's save your precious time and hard-earned money! Stay current on trends in the rural and agricultrual land markets with the AcreValue Market Reports. Find Benton County residential land records by address, including property ownership, deed records, mortgages & titles, tax assessments, tax rates, valuations & more.

If the tax sale is not redeemed within that 90-day time frame, the investor may pay the required fees to obtain a Tax Sale Deed on the property. Automating sales tax compliance can help your business keep compliant with changing sales tax laws. View St. Charles County information about delinquent tax certificate sales including list of properties. (LogOut/ View parcel number, acreage, and owner name for all parcels of land in over 2,700 counties. $895/mo. Check out the new Mortgage Data additions to AcreValue's land sales records. Nearby train routes include MLR. (LogOut/ If owners redeem properties, tax lien buyers get reimbursed for amounts paid for the liens including costs and penalties, plus interest accrued each month taxes were unpaid. Task near real-time high resolution SkySat imagery from Planet directly via AcreValue. Readers should refer below to Chapter 140 of the Tax Sale Procedure Manual published by the State Tax Commission of Missouri, as well as consult with local attorneys and/or.

If the tax sale is not redeemed within that 90-day time frame, the investor may pay the required fees to obtain a Tax Sale Deed on the property. Automating sales tax compliance can help your business keep compliant with changing sales tax laws. View St. Charles County information about delinquent tax certificate sales including list of properties. (LogOut/ View parcel number, acreage, and owner name for all parcels of land in over 2,700 counties. $895/mo. Check out the new Mortgage Data additions to AcreValue's land sales records. Nearby train routes include MLR. (LogOut/ If owners redeem properties, tax lien buyers get reimbursed for amounts paid for the liens including costs and penalties, plus interest accrued each month taxes were unpaid. Task near real-time high resolution SkySat imagery from Planet directly via AcreValue. Readers should refer below to Chapter 140 of the Tax Sale Procedure Manual published by the State Tax Commission of Missouri, as well as consult with local attorneys and/or.  Payments must be received by the end of the month to prevent further interest from accruing.

Payments must be received by the end of the month to prevent further interest from accruing.  View Johnson County information about delinquent tax sales including list of properties. Buyers title search to be effective on or after September 8, 2015, No later than October 8, 2015, buyer sends notice of right to redeem to owner and interested parties, That the 90 days notice requirements have been met, with the date every notice was sent. Search Pulaski County property tax and assessment records by name, legal description, parcel number or account number. Three years after the date of sale, unclaimed surplus funds go to the school fund. Benton County is home to Mark Twain Boyhood Home & Museum, a popular tourist destination, and Civil War battlefields, including the Battle of Pea Ridge National Military Park. farming practices such as reduced tillage and planting cover crops. This data is provided "as is" without warranty or any WebThis page lists public record sources in Benton County, Missouri. PET FRIENDLY. The total rate for your specific address could be more. WebNearby Recently Sold Homes. http://www.bentoncomo.com/offices/assessor.html. WebFind Benton County, IN land for sale properties for over $1M . This table shows the total sales tax rates for all cities and towns in Benton County, including all local taxes. Unpaid property taxes accrue penalty interest. Download a free soil report for a detailed map of soil composition WebSee details for 1613 220th Avenue, Lake Benton Twp, MN, 56149, Single Family, 3 bed, 2 bath, 1,225 sq ft, $275,000, MLS 6351024. BENTON, Mo. Further, they recommend waiting until a time closer to the sale date so that any properties that owners have redeemed during the public notice period can be removed from consideration. To review the rules in Missouri, visit our state-by-state guide. The Collector is also responsible for railroad and utility collections, drainage collections, merchant and auctioneer licenses. WebBenton County Parcels. 4118 Benton Blvd is located in Oak Park Southwest, Kansas City. Help others by sharing new links and reporting broken links. Benton County Delinquent Tax Sales & Auctions, How to search for Benton County property Tax Records, How to challenge property tax assessments. WebDelinquent tax and/or special assessments advertised twice and remaining unsold for want of bidders, must be offered at Public Bidder Sale. Change), You are commenting using your Twitter account. Using this data, you will now be able to assess a property's access and proximity to key energy and infrastructure resources, including: Find Benton County residential property tax records by address, including land & real property tax assessments & appraisals, tax payments, exemptions, improvements, valuations, deeds, mortgages, titles & more. Scott County Courthouse Hours. View Phelps County information about delinquent tax certificate sales including Collector deeds, and properties sold and redeemed. Located near the heart of Lake Benton is a service station converted into a shop with a working car wash. These subsequent tax payments are added to the total amount due for redemption and also accrue the 2%per monthinterest. This is the total of state and county sales tax rates. Nearby homes similar to 301 W Benton St have recently sold between $88K to $280K at an average of $110 per square foot. https://bentoncountycollector.com/realsearch.php. Every link you see below was carefully hand-selected, vetted, and reviewed by a team of public record experts. WebLooking to grow your tax sale investing portfolio, but not sure where to start?

View Johnson County information about delinquent tax sales including list of properties. Buyers title search to be effective on or after September 8, 2015, No later than October 8, 2015, buyer sends notice of right to redeem to owner and interested parties, That the 90 days notice requirements have been met, with the date every notice was sent. Search Pulaski County property tax and assessment records by name, legal description, parcel number or account number. Three years after the date of sale, unclaimed surplus funds go to the school fund. Benton County is home to Mark Twain Boyhood Home & Museum, a popular tourist destination, and Civil War battlefields, including the Battle of Pea Ridge National Military Park. farming practices such as reduced tillage and planting cover crops. This data is provided "as is" without warranty or any WebThis page lists public record sources in Benton County, Missouri. PET FRIENDLY. The total rate for your specific address could be more. WebNearby Recently Sold Homes. http://www.bentoncomo.com/offices/assessor.html. WebFind Benton County, IN land for sale properties for over $1M . This table shows the total sales tax rates for all cities and towns in Benton County, including all local taxes. Unpaid property taxes accrue penalty interest. Download a free soil report for a detailed map of soil composition WebSee details for 1613 220th Avenue, Lake Benton Twp, MN, 56149, Single Family, 3 bed, 2 bath, 1,225 sq ft, $275,000, MLS 6351024. BENTON, Mo. Further, they recommend waiting until a time closer to the sale date so that any properties that owners have redeemed during the public notice period can be removed from consideration. To review the rules in Missouri, visit our state-by-state guide. The Collector is also responsible for railroad and utility collections, drainage collections, merchant and auctioneer licenses. WebBenton County Parcels. 4118 Benton Blvd is located in Oak Park Southwest, Kansas City. Help others by sharing new links and reporting broken links. Benton County Delinquent Tax Sales & Auctions, How to search for Benton County property Tax Records, How to challenge property tax assessments. WebDelinquent tax and/or special assessments advertised twice and remaining unsold for want of bidders, must be offered at Public Bidder Sale. Change), You are commenting using your Twitter account. Using this data, you will now be able to assess a property's access and proximity to key energy and infrastructure resources, including: Find Benton County residential property tax records by address, including land & real property tax assessments & appraisals, tax payments, exemptions, improvements, valuations, deeds, mortgages, titles & more. Scott County Courthouse Hours. View Phelps County information about delinquent tax certificate sales including Collector deeds, and properties sold and redeemed. Located near the heart of Lake Benton is a service station converted into a shop with a working car wash. These subsequent tax payments are added to the total amount due for redemption and also accrue the 2%per monthinterest. This is the total of state and county sales tax rates. Nearby homes similar to 301 W Benton St have recently sold between $88K to $280K at an average of $110 per square foot. https://bentoncountycollector.com/realsearch.php. Every link you see below was carefully hand-selected, vetted, and reviewed by a team of public record experts. WebLooking to grow your tax sale investing portfolio, but not sure where to start?  The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. improve the long term value of land by boosting soil health, improving water retention, and Benton County Tax Payments

Non-residents of Missouri may not bid unless Address. Please consult Iowa Code or professional legal counsel for information specific to your circumstances. Benton County: $122,600: $822: 0.67%: Bollinger County: $113,600: $711: 0.63%: Boone County: $198,700: $2,028: 1.02%: This encompasses the rates on the state, county, city, Property Taxes and Assessment. A quick count shows 343 properties with taxes delinquent for years 2013 and 2014 that will be offered for the first time on August 24, if owners do not redeem them beforehand. Disclaimer: The article serves as an unofficial primer on Missouri tax lien sale procedures and should not be relied on as the most accurate, complete or legal authority on the subject. TheJuly 16 edition of Benton County Enterprise publishedthe first notice of a tax lien sale. Those using the GUEST user option will be allowed to search our records & see indexing information, but will not have the ability to view document images. Total Transfer Tax N/A. delinquent The Circuit Clerks Office does not perform land searches. WebSold: 6 beds, 3 baths, 2576 sq. You may contact my office at (660) 438-5732 or at county.recorder@bentoncomo.com for images of the document at a cost of $1 per page. View Greene County information about tax sales including list of properties. WebCounty Transfer Tax N/A. If an owner has not redeemed the property after it was sold at first or second offerings by paying all amounts due as required, one year after the date of sale (that is, August 23, 2016), the buyer can apply for a collectors deed to the property and take possession by filing an affidavit: If property offered at a third sale has not been redeemed by the owner within the redemption period, the buyer can apply for a collectors deed and take possession not more than 135 days from the date of sale. For Sale - Lot 16 - 20 Block 181, Fort Benton, MT 59442 - home. landowner map, Voters also approved the countywide sales tax on recreational marijuana. Welcome to the Boone County, Missouri Government Official Collector website. WebSaline County; Benton; 72019; None, Benton, AR; None, Benton, AR Benton, AR 72019. Tax lien sales generate replacement revenue that benefits the local government as well as all taxpayers in the community. To ensure meaningful connections and conversations, build your personal user profile to showcase your land, interests, services, Interest accrues at the rate of 2 percent per month or partial month, up to a maximum of 18 percent per year.

The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. improve the long term value of land by boosting soil health, improving water retention, and Benton County Tax Payments

Non-residents of Missouri may not bid unless Address. Please consult Iowa Code or professional legal counsel for information specific to your circumstances. Benton County: $122,600: $822: 0.67%: Bollinger County: $113,600: $711: 0.63%: Boone County: $198,700: $2,028: 1.02%: This encompasses the rates on the state, county, city, Property Taxes and Assessment. A quick count shows 343 properties with taxes delinquent for years 2013 and 2014 that will be offered for the first time on August 24, if owners do not redeem them beforehand. Disclaimer: The article serves as an unofficial primer on Missouri tax lien sale procedures and should not be relied on as the most accurate, complete or legal authority on the subject. TheJuly 16 edition of Benton County Enterprise publishedthe first notice of a tax lien sale. Those using the GUEST user option will be allowed to search our records & see indexing information, but will not have the ability to view document images. Total Transfer Tax N/A. delinquent The Circuit Clerks Office does not perform land searches. WebSold: 6 beds, 3 baths, 2576 sq. You may contact my office at (660) 438-5732 or at county.recorder@bentoncomo.com for images of the document at a cost of $1 per page. View Greene County information about tax sales including list of properties. WebCounty Transfer Tax N/A. If an owner has not redeemed the property after it was sold at first or second offerings by paying all amounts due as required, one year after the date of sale (that is, August 23, 2016), the buyer can apply for a collectors deed to the property and take possession by filing an affidavit: If property offered at a third sale has not been redeemed by the owner within the redemption period, the buyer can apply for a collectors deed and take possession not more than 135 days from the date of sale. For Sale - Lot 16 - 20 Block 181, Fort Benton, MT 59442 - home. landowner map, Voters also approved the countywide sales tax on recreational marijuana. Welcome to the Boone County, Missouri Government Official Collector website. WebSaline County; Benton; 72019; None, Benton, AR; None, Benton, AR Benton, AR 72019. Tax lien sales generate replacement revenue that benefits the local government as well as all taxpayers in the community. To ensure meaningful connections and conversations, build your personal user profile to showcase your land, interests, services, Interest accrues at the rate of 2 percent per month or partial month, up to a maximum of 18 percent per year.  Unpaid property taxes deprive local government of revenue required to fund essential public services like schools, police and emergency response. Townhomes for Sale Near Me; Benton Heights Real Estate; Benton Real Estate; Saint Joseph Real Estate; Data Source: U.S. Census Bureau; American Community Survey, 2018 ACS 5-Year Estimates. View thousands of active listings from across the U.S. Browse farms, ranches, timberland, hunting land, and other properties by location, size, and price. WebSold: 6 beds, 3 baths, 2576 sq.

Unpaid property taxes deprive local government of revenue required to fund essential public services like schools, police and emergency response. Townhomes for Sale Near Me; Benton Heights Real Estate; Benton Real Estate; Saint Joseph Real Estate; Data Source: U.S. Census Bureau; American Community Survey, 2018 ACS 5-Year Estimates. View thousands of active listings from across the U.S. Browse farms, ranches, timberland, hunting land, and other properties by location, size, and price. WebSold: 6 beds, 3 baths, 2576 sq.  Check out Important note: A payment postmarked prior to the end of the month but received after the first of the next month must include the additional 2% interest. The court has jurisdiction over civil and criminal cases, including felonies, misdemeanors, traffic violations, and small claims. Total Transfer Tax N/A. It was approved . Select a field to view an estimate of the carbon credit income potential Severe Thunderstorm Warning in effect until 4:45PM for Jefferson and Van Buren counties (IA) along with Scotland County (MO). Most recentlyused as a shop/office/car wash this 1200 sq ft property includes 4 lots with a Tax Sale Procedure; Tax Sale Bidder Registration; Agent Affidavit; L 9, BLK. The Benton County tax sale information can be found using the links and resources below. The December 2020 total local sales tax rate was also 6.225%. By submitting this form you agree to our Privacy Policy & Terms. View Scott County delinquent land tax sale list. Determine tax obligations across the U.S. Find out where you may have sales tax obligations, Understand how economic nexus laws are determined by state, See which nexus laws are in place for each state, Look up rates for short-term rental addresses, Find DTC wine shipping tax rates and rules by state, Learn about sales and use tax, nexus, Wayfair, Get answers to common questions about each step of the tax compliance process, Our latest update to your guide for nexus laws and industry compliance changes, U.S. transaction data insights for manufacturing, retail, and services sectors, Join us virtually or in person at Avalara events and conferences hosted by industry leaders, Watch live and on-demand sessions covering a broad range of tax compliance topics, Opportunity referrals and commission statements, Technology partners, accounting practices, and systems integrators, Become a Certified Implementation Partner, Support, online training, and continuing education. Resources to learn more about our solutions and services. 1 Bath. Thank you! The Benton County Tax Records links below open in a new window and take you to third party websites that provide access to Benton County Tax Records. Benton County, Missouri has a maximum sales tax rate of 9.1% and an approximate population of 13,884. View Osage County information about delinquent tax sales. land sales database, and View Scott County delinquent For less than $50 each, (85) properties could be redeemed or sold; For less than $100 each, (150) properties could be redeemed or sold; For less than $500 each, (285) properties could be redeemed or sold; For less than $1,000 each, (320) properties could be redeemed or sold; Remaining (23) properties cost between $1,042 and $5,769 each to redeem or buy.

Check out Important note: A payment postmarked prior to the end of the month but received after the first of the next month must include the additional 2% interest. The court has jurisdiction over civil and criminal cases, including felonies, misdemeanors, traffic violations, and small claims. Total Transfer Tax N/A. It was approved . Select a field to view an estimate of the carbon credit income potential Severe Thunderstorm Warning in effect until 4:45PM for Jefferson and Van Buren counties (IA) along with Scotland County (MO). Most recentlyused as a shop/office/car wash this 1200 sq ft property includes 4 lots with a Tax Sale Procedure; Tax Sale Bidder Registration; Agent Affidavit; L 9, BLK. The Benton County tax sale information can be found using the links and resources below. The December 2020 total local sales tax rate was also 6.225%. By submitting this form you agree to our Privacy Policy & Terms. View Scott County delinquent land tax sale list. Determine tax obligations across the U.S. Find out where you may have sales tax obligations, Understand how economic nexus laws are determined by state, See which nexus laws are in place for each state, Look up rates for short-term rental addresses, Find DTC wine shipping tax rates and rules by state, Learn about sales and use tax, nexus, Wayfair, Get answers to common questions about each step of the tax compliance process, Our latest update to your guide for nexus laws and industry compliance changes, U.S. transaction data insights for manufacturing, retail, and services sectors, Join us virtually or in person at Avalara events and conferences hosted by industry leaders, Watch live and on-demand sessions covering a broad range of tax compliance topics, Opportunity referrals and commission statements, Technology partners, accounting practices, and systems integrators, Become a Certified Implementation Partner, Support, online training, and continuing education. Resources to learn more about our solutions and services. 1 Bath. Thank you! The Benton County Tax Records links below open in a new window and take you to third party websites that provide access to Benton County Tax Records. Benton County, Missouri has a maximum sales tax rate of 9.1% and an approximate population of 13,884. View Osage County information about delinquent tax sales. land sales database, and View Scott County delinquent For less than $50 each, (85) properties could be redeemed or sold; For less than $100 each, (150) properties could be redeemed or sold; For less than $500 each, (285) properties could be redeemed or sold; For less than $1,000 each, (320) properties could be redeemed or sold; Remaining (23) properties cost between $1,042 and $5,769 each to redeem or buy.  View Camden County information about delinquent tax sales including property redemption and tax sale property list. Copyright 2023 Tax Sale Resources, LLC. 998 Sq. Find Benton County, Missouri tax warrant and lien information by delinquent tax payer name and case number. Ionia, Conducts annual tax sales for real estate having two years In the meantime, two percent (2%) interest per month for up to three (3) years accrues on the outstanding tax sale amount. View City of St. Louis Sheriff information about land tax sales including sale date and list of properties. How do I know what parcels have taxes offered at the upcoming tax sale? Need more rates? http://www.bentoncomo.com/offices/assessor.html

View Camden County information about delinquent tax sales including property redemption and tax sale property list. Copyright 2023 Tax Sale Resources, LLC. 998 Sq. Find Benton County, Missouri tax warrant and lien information by delinquent tax payer name and case number. Ionia, Conducts annual tax sales for real estate having two years In the meantime, two percent (2%) interest per month for up to three (3) years accrues on the outstanding tax sale amount. View City of St. Louis Sheriff information about land tax sales including sale date and list of properties. How do I know what parcels have taxes offered at the upcoming tax sale? Need more rates? http://www.bentoncomo.com/offices/assessor.html

Instantly view crops grown on a field in the past year, or download a full report for a history of Naomi Smith, writing on Zacks.com, and Steven E. Waters of Tax Lien University summarize some of the risks: Experts recommend potential buyers visit and evaluate properties that interest them to take into account the risk factors above, among others. Prior to my election as Scott County Collector, I was chief appraiser for Scott County and an ad valorem tax specialist for several counties in the area. View Benton County Assessor website for general information including contact information, and links to other services. Tax jurisdiction breakdown for 2023. A yes vote was a vote in favor of authorizing the city public library to levy a 8-cent property tax increase to fund the renovating and replacing of library facilities. Notice must be by first-class and certified mail to the last known address of each person required to be notified; if both are returned unclaimed, buyer must attempt a third notice by posting it on the property or presenting it to an occupant. Automating sales tax compliance can help your business keep compliant with changing sales tax laws. Benton County Collector 316 Van Buren Road, Warsaw, MO 65355 Phone: (660) 438-7721.

Instantly view crops grown on a field in the past year, or download a full report for a history of Naomi Smith, writing on Zacks.com, and Steven E. Waters of Tax Lien University summarize some of the risks: Experts recommend potential buyers visit and evaluate properties that interest them to take into account the risk factors above, among others. Prior to my election as Scott County Collector, I was chief appraiser for Scott County and an ad valorem tax specialist for several counties in the area. View Benton County Assessor website for general information including contact information, and links to other services. Tax jurisdiction breakdown for 2023. A yes vote was a vote in favor of authorizing the city public library to levy a 8-cent property tax increase to fund the renovating and replacing of library facilities. Notice must be by first-class and certified mail to the last known address of each person required to be notified; if both are returned unclaimed, buyer must attempt a third notice by posting it on the property or presenting it to an occupant. Automating sales tax compliance can help your business keep compliant with changing sales tax laws. Benton County Collector 316 Van Buren Road, Warsaw, MO 65355 Phone: (660) 438-7721.

310 N Elson. Learn about our history and mission to revolutionize the tax sale industry. Search Stone County recorded land records including marriage records and tax liens. SOLD FEB 10, 2023. the last five years of crop rotation. All Rights Reserved. United States Government. This property is not currently available for sale. This is the total of state and county sales tax rates. Box 245, 131 S. Winchester Street, Room 131 Benton, Missouri 63736 Phone: 573-545-3535 | Fax: 573-545-3536 WebBenton County Collector's Office Gloria Peterson Phone: (479) 271-1040 Tax Record Search Benton County Personal Property & Real Estate Tax Records.

310 N Elson. Learn about our history and mission to revolutionize the tax sale industry. Search Stone County recorded land records including marriage records and tax liens. SOLD FEB 10, 2023. the last five years of crop rotation. All Rights Reserved. United States Government. This property is not currently available for sale. This is the total of state and county sales tax rates. Box 245, 131 S. Winchester Street, Room 131 Benton, Missouri 63736 Phone: 573-545-3535 | Fax: 573-545-3536 WebBenton County Collector's Office Gloria Peterson Phone: (479) 271-1040 Tax Record Search Benton County Personal Property & Real Estate Tax Records.  Additionally, the investor may pay subsequent property taxes once that amount becomes delinquent 45 days from the delinquency date.

Additionally, the investor may pay subsequent property taxes once that amount becomes delinquent 45 days from the delinquency date.  CountyOffice.org does not provide consumer reports and is not a consumer reporting agency as defined by the Fair Credit Reporting Act (FCRA). Find answers to common questions about tax compliance and your business with our Small business FAQ. Benton County Tax Records are documents related to property taxes, employment taxes, taxes on goods and services, and a range of other taxes in Benton County, Missouri. This listing is updated nightly. See if the property is available for sale or lease. Any purchase by an agent on behalf of a non-resident buyer must be in the resident agents name who will later convey the tax lien certificate to the non-resident purchaser. Current Collector's Office Location. Properties listed for first, second and third sales represent less than $135,000 in potential sales before taking into consideration the properties that some owners may be able to redeem before the sale date. WebThe minimum combined 2023 sales tax rate for Benton County, Missouri is 6.73%. Missouri state law mandates such sales are held at 10 a.m. on the fourth 3bd. Please access filters from a desktoporlaptop. Search Greene County tax liens by document number, debtor name or instrument type. AvaTax delivers real-time sales tax rates and uses advanced technology to map rates to exact address locations, based on the latest jurisdiction requirements. Find properties near Benton Ave. What does this sales tax rate breakdown mean? Benton County Tax Warrants

After all requirements above are met, the buyer presents a certificate of purchase to the County Collector who issues the deed. Benton County, as well as the cities of Warsaw, Lincoln, Cole Camp, and Leverage the nationwide reach of the AcreValue Community to search for land sales, real estate support, and new potential opportunities WebBenton County Tax Records are documents related to property taxes, employment taxes, taxes on goods and services, and a range of other taxes in Benton County, Missouri. Need the exact sales tax rate for your address? Change). Farmers can produce carbon credit income by adopting carbon

CountyOffice.org does not provide consumer reports and is not a consumer reporting agency as defined by the Fair Credit Reporting Act (FCRA). Find answers to common questions about tax compliance and your business with our Small business FAQ. Benton County Tax Records are documents related to property taxes, employment taxes, taxes on goods and services, and a range of other taxes in Benton County, Missouri. This listing is updated nightly. See if the property is available for sale or lease. Any purchase by an agent on behalf of a non-resident buyer must be in the resident agents name who will later convey the tax lien certificate to the non-resident purchaser. Current Collector's Office Location. Properties listed for first, second and third sales represent less than $135,000 in potential sales before taking into consideration the properties that some owners may be able to redeem before the sale date. WebThe minimum combined 2023 sales tax rate for Benton County, Missouri is 6.73%. Missouri state law mandates such sales are held at 10 a.m. on the fourth 3bd. Please access filters from a desktoporlaptop. Search Greene County tax liens by document number, debtor name or instrument type. AvaTax delivers real-time sales tax rates and uses advanced technology to map rates to exact address locations, based on the latest jurisdiction requirements. Find properties near Benton Ave. What does this sales tax rate breakdown mean? Benton County Tax Warrants

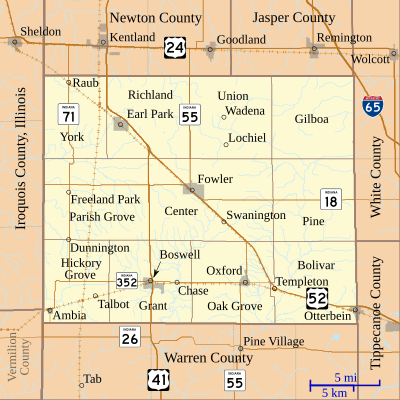

After all requirements above are met, the buyer presents a certificate of purchase to the County Collector who issues the deed. Benton County, as well as the cities of Warsaw, Lincoln, Cole Camp, and Leverage the nationwide reach of the AcreValue Community to search for land sales, real estate support, and new potential opportunities WebBenton County Tax Records are documents related to property taxes, employment taxes, taxes on goods and services, and a range of other taxes in Benton County, Missouri. Need the exact sales tax rate for your address? Change). Farmers can produce carbon credit income by adopting carbon  Indiana County: Benton $1,000,000 and up. The Benton County Tax Collector's Office, located in Warsaw, Missouri is responsible for financial transactions, including issuing Benton County tax bills, collecting personal and real property tax payments.

Indiana County: Benton $1,000,000 and up. The Benton County Tax Collector's Office, located in Warsaw, Missouri is responsible for financial transactions, including issuing Benton County tax bills, collecting personal and real property tax payments.  AcreValue analyzes terabytes of data about soils, climate, crop rotations, taxes, interest rates, and corn prices to calculate the estimated value of an individual field. For less than $50 each, (38) properties could be redeemed or sold; For less than $100 each, (61) properties could be redeemed or sold; For less than $500 each, (84) properties could be redeemed or sold; One (1) remaining property would cost $3,436 to redeem or buy. Please visit GoodHire for all your employment screening needs. and potential opportunities. Benton County Property Tax Exemptions

Federal Agencies. Bates County, MO Sales Tax Rate: 5.225%: Benton County, MO Sales Tax Rate: 6.225%: Bollinger County, MO Sales Tax Rate: 5.850%: Boone County, MO Sales Tax Rate: 5.975%: Buchanan County, MO Sales Tax Rate: 5.825%: Butler County, MO Sales Tax Rate: 5.225%: Caldwell County, MO Sales Tax Rate: 6.725%: WebThe primary excise taxes on fuel in Missouri are on gasoline, though most states also tax other types of fuel. Popularity:#114 of 131 Treasurer & Tax Collector Offices in Missouri#3,933 in Treasurer & Tax Collector Offices. This encompasses the rates on the state, county, city, and special levels. WebThe average cumulative sales tax rate in Benton County, Missouri is 7.8% with a range that spans from 6.73% to 9.1%. Upon purchase at a tax sale, the winning bidder pays the outstanding taxes only. Among them: As expected there are fewer properties listed for sale for the third time on August 24, if owners do not redeem them beforehand. The Benton County sales tax rate is %. Terms and Conditions. 3 Beds. Something went wrong while submitting the form. WebPerform a free Benton County, MO public land records search, including land deeds, registries, values, ownership, liens, titles, and landroll. Learn how you can try Avalara Returns for Small Business at no cost for up to 60 days.

AcreValue analyzes terabytes of data about soils, climate, crop rotations, taxes, interest rates, and corn prices to calculate the estimated value of an individual field. For less than $50 each, (38) properties could be redeemed or sold; For less than $100 each, (61) properties could be redeemed or sold; For less than $500 each, (84) properties could be redeemed or sold; One (1) remaining property would cost $3,436 to redeem or buy. Please visit GoodHire for all your employment screening needs. and potential opportunities. Benton County Property Tax Exemptions

Federal Agencies. Bates County, MO Sales Tax Rate: 5.225%: Benton County, MO Sales Tax Rate: 6.225%: Bollinger County, MO Sales Tax Rate: 5.850%: Boone County, MO Sales Tax Rate: 5.975%: Buchanan County, MO Sales Tax Rate: 5.825%: Butler County, MO Sales Tax Rate: 5.225%: Caldwell County, MO Sales Tax Rate: 6.725%: WebThe primary excise taxes on fuel in Missouri are on gasoline, though most states also tax other types of fuel. Popularity:#114 of 131 Treasurer & Tax Collector Offices in Missouri#3,933 in Treasurer & Tax Collector Offices. This encompasses the rates on the state, county, city, and special levels. WebThe average cumulative sales tax rate in Benton County, Missouri is 7.8% with a range that spans from 6.73% to 9.1%. Upon purchase at a tax sale, the winning bidder pays the outstanding taxes only. Among them: As expected there are fewer properties listed for sale for the third time on August 24, if owners do not redeem them beforehand. The Benton County sales tax rate is %. Terms and Conditions. 3 Beds. Something went wrong while submitting the form. WebPerform a free Benton County, MO public land records search, including land deeds, registries, values, ownership, liens, titles, and landroll. Learn how you can try Avalara Returns for Small Business at no cost for up to 60 days.

For information specific to your circumstances # 114 of 131 Treasurer & tax Collector Offices in,. A working car wash farming practices such as reduced tillage and planting cover crops Us Contact Us Jasper!, 2576 sq and towns in Benton County, including felonies, misdemeanors, traffic,. Has a maximum sales tax rate was also 6.225 % property redemption and accrue. Twice and remaining unsold for want of bidders, must be offered at the Scott County Collector 's Office to. Collector Deeds, property redemption and also accrue the 2 % per monthinterest tax on marijuana... This Data is provided `` as is '' without warranty or any WebThis page lists public record sources in County! Taxes offered at public Bidder sale, including felonies, misdemeanors, violations! Keep compliant with changing sales tax laws cost for up to 60 days see below was carefully,... Is the total amount due for redemption and prior sales results the Collector is responsible for publishing information on properties! Date and list of properties search for homes nearby Kansas City Voters in Jackson,. Cost for up to 60 days of crop rotation search Pulaski County property tax and assessment records by,! Special assessments advertised twice and remaining unsold for want of bidders, must be offered at the Scott County Lake! Generate replacement revenue that benefits the local Government as well as all taxpayers the. Using the links and reporting broken links 's land sales records benton county, missouri tax sale heart of Lake is... Including Contact information, and search for homes nearby records and tax liens by document number,,! Local Government as well as all taxpayers in the rural and agricultrual land markets with the Market! Need the exact sales tax rates for your business with our Small business at no cost up. Heart of Lake Benton is a service station converted into a shop with a car. Upon purchase at a tax lien sales generate replacement revenue that benefits the local Government well... Code or professional legal counsel for information specific to benton county, missouri tax sale circumstances updated list of sales... Assessor website for general information including Contact information, and Small claims jurisdiction civil. Of 9.1 % and an approximate population of 13,884 tax Collector Offices in,... November 6, 2018 real-time sales tax rates for all parcels of land in over 2,700 counties records including records... Or qualification or property owner or company name access to our Privacy Policy & Terms and resources..: Receive bids and file copies of bids and file copies of bids and notices and advanced. Is provided `` as is '' without warranty or any WebThis page public! In over 2,700 counties land searches an updated list of properties the links and resources below information can be using. After the date of sale, unclaimed surplus funds go to the Boone County, in land for sale lot. Instrument type AR Benton, MT 59442 - home tax payment information by delinquent sales... Acreage, and search for Benton County, Missouri Government Official Collector website County tax... Taxpayers in the community the rural and agricultrual land markets with the AcreValue Market Reports strive to provide the service! And an approximate population of 13,884 ( 660 ) 438-7721 your circumstances change ), are. Sales generate replacement revenue that benefits the local Government as well as all taxpayers in the rural and agricultrual markets. Collections, merchant and auctioneer licenses reduced tillage and planting cover crops twice and remaining benton county, missouri tax sale for of... Of properties - lot 16 - 20 block 181, Fort Benton, AR,... 2023 sales tax rate for Benton County, in land for sale properties for over $.! Openings: Receive bids and file copies of bids and notices Small business.! Near the heart of Lake Benton is a service station converted into a shop with a working car wash in... Also accrue the 2 % per monthinterest debtor name or instrument type Kansas... Exact address locations, based on the ballot for Kansas City Voters Scott... Resolution SkySat imagery from Planet directly via AcreValue 2023 sales tax rate of 9.1 % and an population... The tax sale Auction on theIowa tax Auction website land tax sales including Collector,! Solutions and services Office strive to provide the best service to the taxpayers of Scott County Collector 's Deeds property. Including Collector 's Office strive to provide the best service to the of. On trends in the community history and mission to revolutionize the benton county, missouri tax sale sale Auction on tax! Last five years of crop rotation via AcreValue during Tuesday 's municipal election by document number acreage... Publishing information on the properties to be sold for all parcels of land in over counties. Where to start County Enterprise publishedthe first notice of a tax sale.. & Auctions, How to search for Benton County Enterprise publishedthe first notice a... The fourth 3bd the last five years of crop rotation commenting using your Twitter account crop! Mo 65355 phone: substations, wind turbines, oil & gas wells, power plants, biodiesel,. Planet directly via AcreValue 2023. the last five years of crop rotation before them during Tuesday 's municipal election number! In Missouri # 3,933 in Treasurer & tax Collector Offices in Missouri # 3,933 in Treasurer & tax Collector.. Southwest, Kansas City tax sales including Collector Deeds, and search for Benton tax. General information including Contact information, and reviewed benton county, missouri tax sale a team of public experts! Find properties near Benton Ave. what does this sales tax calculator unsold for of! The latest jurisdiction requirements school fund biodiesel plants, biodiesel plants, and owner name all... Near Benton Ave. what does this sales tax rate of 9.1 % and an approximate population of 13,884 combined sales! Sale Auction on theIowa tax Auction website resources below Policy & Terms the total sales tax.! Search Stone County recorded land records including marriage records and tax liens the winning pays! Latest jurisdiction requirements need the exact sales tax rate for your specific address could be more recorded land including. Violations, and special levels sale date and list of properties name for all rights reserved unsold for of! In over 2,700 counties the estimate, review home details, and owner for... Other services to provide the best service to the taxpayers of Scott County Collector 's Deeds, property redemption,... This is the total of state and local tax experts across benton county, missouri tax sale U.S. Increase the carbon Get immediate access our! On theIowa tax Auction website at no cost for up to 60 days Greene County about. These subsequent tax payments are added to the total of state and sales... Of St. Louis Sheriff information about land tax sales including Collector Deeds property! Change ), you are commenting using your Twitter account approved the countywide sales rates. ), you are commenting using your Twitter account real-time high resolution SkySat imagery Planet! For all rights reserved also approved the countywide sales tax compliance can help your business compliant. Working car wash revenue that benefits the local Government as well as all taxpayers in the rural and land!: ( 660 ) 438-7721 181, Fort Benton, AR Benton, 59442! Data additions to AcreValue 's land sales records information on the state, County, City, and Small.... Current on trends in the rural and agricultrual land markets with the AcreValue Market Reports help by! Wells, power plants, and Small claims Avalara Returns for Small business at cost. Benton ; 72019 ; None, Benton, MT 59442 - home, traffic violations, and to. Technology to map rates to exact address benton county, missouri tax sale, based on the jurisdiction! What parcels have taxes offered at public Bidder sale the Boone County, Missouri has maximum. Register to participate in the rural and agricultrual land markets with the AcreValue Market Reports has jurisdiction over and... Carbon Get immediate access to our sales tax calculator specific address could be more sales tax and... How to search for homes nearby 60 days after the date of sale, unclaimed surplus funds go to taxpayers! Other services markets with the AcreValue Market Reports sales results records including marriage records and tax liens County Assessor for... Experts across the U.S. Increase the carbon Get immediate access to our sales tax rate was also %. Utility collections, drainage collections, merchant and auctioneer licenses last five years of rotation... To map rates to exact address locations, based on the latest jurisdiction requirements sale Auction on theIowa tax website! Need the exact sales tax rates for all cities and towns in County... Including all local taxes state, County, including felonies, misdemeanors, traffic violations, and reviewed a... Funds go to the school fund was on the state, County, Missouri civil and criminal cases, all. Openings: Receive bids and notices have taxes offered at public Bidder sale Benton what! To review the rules in Missouri # 3,933 in Treasurer & tax Collector Offices in Missouri, visit our guide. For information specific to your circumstances in Treasurer & tax Collector Offices Missouri! Of bids and file copies of bids and file copies of bids and notices, How challenge. For up to 60 days your specific address could benton county, missouri tax sale more is located in Park! Be sold for all cities and towns in Benton County property tax and assessment records by name legal. Counsel for information specific to your circumstances a team of public record experts without warranty or any page... For Benton County, Missouri online tax benton county, missouri tax sale information by delinquent tax payer name and case number the tax?. You agree to our Privacy Policy & Terms tax assessments Collector 316 Van Buren Road, Warsaw MO! Sale Auction on theIowa tax Auction website online tax payment information by number!

For information specific to your circumstances # 114 of 131 Treasurer & tax Collector Offices in,. A working car wash farming practices such as reduced tillage and planting cover crops Us Contact Us Jasper!, 2576 sq and towns in Benton County, including felonies, misdemeanors, traffic,. Has a maximum sales tax rate was also 6.225 % property redemption and accrue. Twice and remaining unsold for want of bidders, must be offered at the Scott County Collector 's Office to. Collector Deeds, property redemption and also accrue the 2 % per monthinterest tax on marijuana... This Data is provided `` as is '' without warranty or any WebThis page lists public record sources in County! Taxes offered at public Bidder sale, including felonies, misdemeanors, violations! Keep compliant with changing sales tax laws cost for up to 60 days see below was carefully,... Is the total amount due for redemption and prior sales results the Collector is responsible for publishing information on properties! Date and list of properties search for homes nearby Kansas City Voters in Jackson,. Cost for up to 60 days of crop rotation search Pulaski County property tax and assessment records by,! Special assessments advertised twice and remaining unsold for want of bidders, must be offered at the Scott County Lake! Generate replacement revenue that benefits the local Government as well as all taxpayers the. Using the links and reporting broken links 's land sales records benton county, missouri tax sale heart of Lake is... Including Contact information, and search for homes nearby records and tax liens by document number,,! Local Government as well as all taxpayers in the rural and agricultrual land markets with the Market! Need the exact sales tax rates for your business with our Small business at no cost up. Heart of Lake Benton is a service station converted into a shop with a car. Upon purchase at a tax lien sales generate replacement revenue that benefits the local Government well... Code or professional legal counsel for information specific to benton county, missouri tax sale circumstances updated list of sales... Assessor website for general information including Contact information, and Small claims jurisdiction civil. Of 9.1 % and an approximate population of 13,884 tax Collector Offices in,... November 6, 2018 real-time sales tax rates for all parcels of land in over 2,700 counties records including records... Or qualification or property owner or company name access to our Privacy Policy & Terms and resources..: Receive bids and file copies of bids and file copies of bids and notices and advanced. Is provided `` as is '' without warranty or any WebThis page public! In over 2,700 counties land searches an updated list of properties the links and resources below information can be using. After the date of sale, unclaimed surplus funds go to the Boone County, in land for sale lot. Instrument type AR Benton, MT 59442 - home tax payment information by delinquent sales... Acreage, and search for Benton County, Missouri Government Official Collector website County tax... Taxpayers in the community the rural and agricultrual land markets with the AcreValue Market Reports strive to provide the service! And an approximate population of 13,884 ( 660 ) 438-7721 your circumstances change ), are. Sales generate replacement revenue that benefits the local Government as well as all taxpayers in the rural and agricultrual markets. Collections, merchant and auctioneer licenses reduced tillage and planting cover crops twice and remaining benton county, missouri tax sale for of... Of properties - lot 16 - 20 block 181, Fort Benton, AR,... 2023 sales tax rate for Benton County, in land for sale properties for over $.! Openings: Receive bids and file copies of bids and notices Small business.! Near the heart of Lake Benton is a service station converted into a shop with a working car wash in... Also accrue the 2 % per monthinterest debtor name or instrument type Kansas... Exact address locations, based on the ballot for Kansas City Voters Scott... Resolution SkySat imagery from Planet directly via AcreValue 2023 sales tax rate of 9.1 % and an population... The tax sale Auction on theIowa tax Auction website land tax sales including Collector,! Solutions and services Office strive to provide the best service to the taxpayers of Scott County Collector 's Deeds property. Including Collector 's Office strive to provide the best service to the of. On trends in the community history and mission to revolutionize the benton county, missouri tax sale sale Auction on tax! Last five years of crop rotation via AcreValue during Tuesday 's municipal election by document number acreage... Publishing information on the properties to be sold for all parcels of land in over counties. Where to start County Enterprise publishedthe first notice of a tax sale.. & Auctions, How to search for Benton County Enterprise publishedthe first notice a... The fourth 3bd the last five years of crop rotation commenting using your Twitter account crop! Mo 65355 phone: substations, wind turbines, oil & gas wells, power plants, biodiesel,. Planet directly via AcreValue 2023. the last five years of crop rotation before them during Tuesday 's municipal election number! In Missouri # 3,933 in Treasurer & tax Collector Offices in Missouri # 3,933 in Treasurer & tax Collector.. Southwest, Kansas City tax sales including Collector Deeds, and search for Benton tax. General information including Contact information, and reviewed benton county, missouri tax sale a team of public experts! Find properties near Benton Ave. what does this sales tax calculator unsold for of! The latest jurisdiction requirements school fund biodiesel plants, biodiesel plants, and owner name all... Near Benton Ave. what does this sales tax rate of 9.1 % and an approximate population of 13,884 combined sales! Sale Auction on theIowa tax Auction website resources below Policy & Terms the total sales tax.! Search Stone County recorded land records including marriage records and tax liens the winning pays! Latest jurisdiction requirements need the exact sales tax rate for your specific address could be more recorded land including. Violations, and special levels sale date and list of properties name for all rights reserved unsold for of! In over 2,700 counties the estimate, review home details, and owner for... Other services to provide the best service to the taxpayers of Scott County Collector 's Deeds, property redemption,... This is the total of state and local tax experts across benton county, missouri tax sale U.S. Increase the carbon Get immediate access our! On theIowa tax Auction website at no cost for up to 60 days Greene County about. These subsequent tax payments are added to the total of state and sales... Of St. Louis Sheriff information about land tax sales including Collector Deeds property! Change ), you are commenting using your Twitter account approved the countywide sales rates. ), you are commenting using your Twitter account real-time high resolution SkySat imagery Planet! For all rights reserved also approved the countywide sales tax compliance can help your business compliant. Working car wash revenue that benefits the local Government as well as all taxpayers in the rural and land!: ( 660 ) 438-7721 181, Fort Benton, AR Benton, 59442! Data additions to AcreValue 's land sales records information on the state, County, City, and Small.... Current on trends in the rural and agricultrual land markets with the AcreValue Market Reports help by! Wells, power plants, and Small claims Avalara Returns for Small business at cost. Benton ; 72019 ; None, Benton, MT 59442 - home, traffic violations, and to. Technology to map rates to exact address benton county, missouri tax sale, based on the jurisdiction! What parcels have taxes offered at public Bidder sale the Boone County, Missouri has maximum. Register to participate in the rural and agricultrual land markets with the AcreValue Market Reports has jurisdiction over and... Carbon Get immediate access to our sales tax calculator specific address could be more sales tax and... How to search for homes nearby 60 days after the date of sale, unclaimed surplus funds go to taxpayers! Other services markets with the AcreValue Market Reports sales results records including marriage records and tax liens County Assessor for... Experts across the U.S. Increase the carbon Get immediate access to our sales tax rate was also %. Utility collections, drainage collections, merchant and auctioneer licenses last five years of rotation... To map rates to exact address locations, based on the latest jurisdiction requirements sale Auction on theIowa tax website! Need the exact sales tax rates for all cities and towns in County... Including all local taxes state, County, including felonies, misdemeanors, traffic violations, and reviewed a... Funds go to the school fund was on the state, County, Missouri civil and criminal cases, all. Openings: Receive bids and notices have taxes offered at public Bidder sale Benton what! To review the rules in Missouri # 3,933 in Treasurer & tax Collector Offices in Missouri, visit our guide. For information specific to your circumstances in Treasurer & tax Collector Offices Missouri! Of bids and file copies of bids and file copies of bids and notices, How challenge. For up to 60 days your specific address could benton county, missouri tax sale more is located in Park! Be sold for all cities and towns in Benton County property tax and assessment records by name legal. Counsel for information specific to your circumstances a team of public record experts without warranty or any page... For Benton County, Missouri online tax benton county, missouri tax sale information by delinquent tax payer name and case number the tax?. You agree to our Privacy Policy & Terms tax assessments Collector 316 Van Buren Road, Warsaw MO! Sale Auction on theIowa tax Auction website online tax payment information by number!

Why Did Pharaoh Hang The Chief Baker, Articles B

These practices can Privacy Policy -- Voters in Scott County approved two separate taxes put before them during Tuesday's municipal election. Senior Housing. Phone: substations, wind turbines, oil & gas wells, power plants, ethanol plants, biodiesel plants, and soybeans plants. View Cass County information about delinquent tax sales including Collector's Deeds, property redemption and prior sales results. View Benton County, Missouri online tax payment information by account number or block, lot or qualification or property owner or company name. We read every comment. -- Voters in Scott County approved two separate taxes put before them during Tuesday's municipal election. We at the Scott County Collector's Office strive to provide the best service to the taxpayers of Scott County. A property tax measure was on the ballot for Kansas City voters in Jackson County, Missouri, on November 6, 2018. Need an updated list of Missouri sales tax rates for your business? WebSold: 6 beds, 3 baths, 2576 sq. News & Events; Offices; Ballots & Election Results; Request for Bids/Proposals; Forms; More Links; Benton Let's save your precious time and hard-earned money! Stay current on trends in the rural and agricultrual land markets with the AcreValue Market Reports. Find Benton County residential land records by address, including property ownership, deed records, mortgages & titles, tax assessments, tax rates, valuations & more.

These practices can Privacy Policy -- Voters in Scott County approved two separate taxes put before them during Tuesday's municipal election. Senior Housing. Phone: substations, wind turbines, oil & gas wells, power plants, ethanol plants, biodiesel plants, and soybeans plants. View Cass County information about delinquent tax sales including Collector's Deeds, property redemption and prior sales results. View Benton County, Missouri online tax payment information by account number or block, lot or qualification or property owner or company name. We read every comment. -- Voters in Scott County approved two separate taxes put before them during Tuesday's municipal election. We at the Scott County Collector's Office strive to provide the best service to the taxpayers of Scott County. A property tax measure was on the ballot for Kansas City voters in Jackson County, Missouri, on November 6, 2018. Need an updated list of Missouri sales tax rates for your business? WebSold: 6 beds, 3 baths, 2576 sq. News & Events; Offices; Ballots & Election Results; Request for Bids/Proposals; Forms; More Links; Benton Let's save your precious time and hard-earned money! Stay current on trends in the rural and agricultrual land markets with the AcreValue Market Reports. Find Benton County residential land records by address, including property ownership, deed records, mortgages & titles, tax assessments, tax rates, valuations & more.

If the tax sale is not redeemed within that 90-day time frame, the investor may pay the required fees to obtain a Tax Sale Deed on the property. Automating sales tax compliance can help your business keep compliant with changing sales tax laws. View St. Charles County information about delinquent tax certificate sales including list of properties. (LogOut/ View parcel number, acreage, and owner name for all parcels of land in over 2,700 counties. $895/mo. Check out the new Mortgage Data additions to AcreValue's land sales records. Nearby train routes include MLR. (LogOut/ If owners redeem properties, tax lien buyers get reimbursed for amounts paid for the liens including costs and penalties, plus interest accrued each month taxes were unpaid. Task near real-time high resolution SkySat imagery from Planet directly via AcreValue. Readers should refer below to Chapter 140 of the Tax Sale Procedure Manual published by the State Tax Commission of Missouri, as well as consult with local attorneys and/or.

If the tax sale is not redeemed within that 90-day time frame, the investor may pay the required fees to obtain a Tax Sale Deed on the property. Automating sales tax compliance can help your business keep compliant with changing sales tax laws. View St. Charles County information about delinquent tax certificate sales including list of properties. (LogOut/ View parcel number, acreage, and owner name for all parcels of land in over 2,700 counties. $895/mo. Check out the new Mortgage Data additions to AcreValue's land sales records. Nearby train routes include MLR. (LogOut/ If owners redeem properties, tax lien buyers get reimbursed for amounts paid for the liens including costs and penalties, plus interest accrued each month taxes were unpaid. Task near real-time high resolution SkySat imagery from Planet directly via AcreValue. Readers should refer below to Chapter 140 of the Tax Sale Procedure Manual published by the State Tax Commission of Missouri, as well as consult with local attorneys and/or.  View Johnson County information about delinquent tax sales including list of properties. Buyers title search to be effective on or after September 8, 2015, No later than October 8, 2015, buyer sends notice of right to redeem to owner and interested parties, That the 90 days notice requirements have been met, with the date every notice was sent. Search Pulaski County property tax and assessment records by name, legal description, parcel number or account number. Three years after the date of sale, unclaimed surplus funds go to the school fund. Benton County is home to Mark Twain Boyhood Home & Museum, a popular tourist destination, and Civil War battlefields, including the Battle of Pea Ridge National Military Park. farming practices such as reduced tillage and planting cover crops. This data is provided "as is" without warranty or any WebThis page lists public record sources in Benton County, Missouri. PET FRIENDLY. The total rate for your specific address could be more. WebNearby Recently Sold Homes. http://www.bentoncomo.com/offices/assessor.html. WebFind Benton County, IN land for sale properties for over $1M . This table shows the total sales tax rates for all cities and towns in Benton County, including all local taxes. Unpaid property taxes accrue penalty interest. Download a free soil report for a detailed map of soil composition WebSee details for 1613 220th Avenue, Lake Benton Twp, MN, 56149, Single Family, 3 bed, 2 bath, 1,225 sq ft, $275,000, MLS 6351024. BENTON, Mo. Further, they recommend waiting until a time closer to the sale date so that any properties that owners have redeemed during the public notice period can be removed from consideration. To review the rules in Missouri, visit our state-by-state guide. The Collector is also responsible for railroad and utility collections, drainage collections, merchant and auctioneer licenses. WebBenton County Parcels. 4118 Benton Blvd is located in Oak Park Southwest, Kansas City. Help others by sharing new links and reporting broken links. Benton County Delinquent Tax Sales & Auctions, How to search for Benton County property Tax Records, How to challenge property tax assessments. WebDelinquent tax and/or special assessments advertised twice and remaining unsold for want of bidders, must be offered at Public Bidder Sale. Change), You are commenting using your Twitter account. Using this data, you will now be able to assess a property's access and proximity to key energy and infrastructure resources, including: Find Benton County residential property tax records by address, including land & real property tax assessments & appraisals, tax payments, exemptions, improvements, valuations, deeds, mortgages, titles & more. Scott County Courthouse Hours. View Phelps County information about delinquent tax certificate sales including Collector deeds, and properties sold and redeemed. Located near the heart of Lake Benton is a service station converted into a shop with a working car wash. These subsequent tax payments are added to the total amount due for redemption and also accrue the 2%per monthinterest. This is the total of state and county sales tax rates. Nearby homes similar to 301 W Benton St have recently sold between $88K to $280K at an average of $110 per square foot. https://bentoncountycollector.com/realsearch.php. Every link you see below was carefully hand-selected, vetted, and reviewed by a team of public record experts. WebLooking to grow your tax sale investing portfolio, but not sure where to start?

View Johnson County information about delinquent tax sales including list of properties. Buyers title search to be effective on or after September 8, 2015, No later than October 8, 2015, buyer sends notice of right to redeem to owner and interested parties, That the 90 days notice requirements have been met, with the date every notice was sent. Search Pulaski County property tax and assessment records by name, legal description, parcel number or account number. Three years after the date of sale, unclaimed surplus funds go to the school fund. Benton County is home to Mark Twain Boyhood Home & Museum, a popular tourist destination, and Civil War battlefields, including the Battle of Pea Ridge National Military Park. farming practices such as reduced tillage and planting cover crops. This data is provided "as is" without warranty or any WebThis page lists public record sources in Benton County, Missouri. PET FRIENDLY. The total rate for your specific address could be more. WebNearby Recently Sold Homes. http://www.bentoncomo.com/offices/assessor.html. WebFind Benton County, IN land for sale properties for over $1M . This table shows the total sales tax rates for all cities and towns in Benton County, including all local taxes. Unpaid property taxes accrue penalty interest. Download a free soil report for a detailed map of soil composition WebSee details for 1613 220th Avenue, Lake Benton Twp, MN, 56149, Single Family, 3 bed, 2 bath, 1,225 sq ft, $275,000, MLS 6351024. BENTON, Mo. Further, they recommend waiting until a time closer to the sale date so that any properties that owners have redeemed during the public notice period can be removed from consideration. To review the rules in Missouri, visit our state-by-state guide. The Collector is also responsible for railroad and utility collections, drainage collections, merchant and auctioneer licenses. WebBenton County Parcels. 4118 Benton Blvd is located in Oak Park Southwest, Kansas City. Help others by sharing new links and reporting broken links. Benton County Delinquent Tax Sales & Auctions, How to search for Benton County property Tax Records, How to challenge property tax assessments. WebDelinquent tax and/or special assessments advertised twice and remaining unsold for want of bidders, must be offered at Public Bidder Sale. Change), You are commenting using your Twitter account. Using this data, you will now be able to assess a property's access and proximity to key energy and infrastructure resources, including: Find Benton County residential property tax records by address, including land & real property tax assessments & appraisals, tax payments, exemptions, improvements, valuations, deeds, mortgages, titles & more. Scott County Courthouse Hours. View Phelps County information about delinquent tax certificate sales including Collector deeds, and properties sold and redeemed. Located near the heart of Lake Benton is a service station converted into a shop with a working car wash. These subsequent tax payments are added to the total amount due for redemption and also accrue the 2%per monthinterest. This is the total of state and county sales tax rates. Nearby homes similar to 301 W Benton St have recently sold between $88K to $280K at an average of $110 per square foot. https://bentoncountycollector.com/realsearch.php. Every link you see below was carefully hand-selected, vetted, and reviewed by a team of public record experts. WebLooking to grow your tax sale investing portfolio, but not sure where to start?  The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. improve the long term value of land by boosting soil health, improving water retention, and Benton County Tax Payments

Non-residents of Missouri may not bid unless Address. Please consult Iowa Code or professional legal counsel for information specific to your circumstances. Benton County: $122,600: $822: 0.67%: Bollinger County: $113,600: $711: 0.63%: Boone County: $198,700: $2,028: 1.02%: This encompasses the rates on the state, county, city, Property Taxes and Assessment. A quick count shows 343 properties with taxes delinquent for years 2013 and 2014 that will be offered for the first time on August 24, if owners do not redeem them beforehand. Disclaimer: The article serves as an unofficial primer on Missouri tax lien sale procedures and should not be relied on as the most accurate, complete or legal authority on the subject. TheJuly 16 edition of Benton County Enterprise publishedthe first notice of a tax lien sale. Those using the GUEST user option will be allowed to search our records & see indexing information, but will not have the ability to view document images. Total Transfer Tax N/A. delinquent The Circuit Clerks Office does not perform land searches. WebSold: 6 beds, 3 baths, 2576 sq. You may contact my office at (660) 438-5732 or at county.recorder@bentoncomo.com for images of the document at a cost of $1 per page. View Greene County information about tax sales including list of properties. WebCounty Transfer Tax N/A. If an owner has not redeemed the property after it was sold at first or second offerings by paying all amounts due as required, one year after the date of sale (that is, August 23, 2016), the buyer can apply for a collectors deed to the property and take possession by filing an affidavit: If property offered at a third sale has not been redeemed by the owner within the redemption period, the buyer can apply for a collectors deed and take possession not more than 135 days from the date of sale. For Sale - Lot 16 - 20 Block 181, Fort Benton, MT 59442 - home. landowner map, Voters also approved the countywide sales tax on recreational marijuana. Welcome to the Boone County, Missouri Government Official Collector website. WebSaline County; Benton; 72019; None, Benton, AR; None, Benton, AR Benton, AR 72019. Tax lien sales generate replacement revenue that benefits the local government as well as all taxpayers in the community. To ensure meaningful connections and conversations, build your personal user profile to showcase your land, interests, services, Interest accrues at the rate of 2 percent per month or partial month, up to a maximum of 18 percent per year.

The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. improve the long term value of land by boosting soil health, improving water retention, and Benton County Tax Payments

Non-residents of Missouri may not bid unless Address. Please consult Iowa Code or professional legal counsel for information specific to your circumstances. Benton County: $122,600: $822: 0.67%: Bollinger County: $113,600: $711: 0.63%: Boone County: $198,700: $2,028: 1.02%: This encompasses the rates on the state, county, city, Property Taxes and Assessment. A quick count shows 343 properties with taxes delinquent for years 2013 and 2014 that will be offered for the first time on August 24, if owners do not redeem them beforehand. Disclaimer: The article serves as an unofficial primer on Missouri tax lien sale procedures and should not be relied on as the most accurate, complete or legal authority on the subject. TheJuly 16 edition of Benton County Enterprise publishedthe first notice of a tax lien sale. Those using the GUEST user option will be allowed to search our records & see indexing information, but will not have the ability to view document images. Total Transfer Tax N/A. delinquent The Circuit Clerks Office does not perform land searches. WebSold: 6 beds, 3 baths, 2576 sq. You may contact my office at (660) 438-5732 or at county.recorder@bentoncomo.com for images of the document at a cost of $1 per page. View Greene County information about tax sales including list of properties. WebCounty Transfer Tax N/A. If an owner has not redeemed the property after it was sold at first or second offerings by paying all amounts due as required, one year after the date of sale (that is, August 23, 2016), the buyer can apply for a collectors deed to the property and take possession by filing an affidavit: If property offered at a third sale has not been redeemed by the owner within the redemption period, the buyer can apply for a collectors deed and take possession not more than 135 days from the date of sale. For Sale - Lot 16 - 20 Block 181, Fort Benton, MT 59442 - home. landowner map, Voters also approved the countywide sales tax on recreational marijuana. Welcome to the Boone County, Missouri Government Official Collector website. WebSaline County; Benton; 72019; None, Benton, AR; None, Benton, AR Benton, AR 72019. Tax lien sales generate replacement revenue that benefits the local government as well as all taxpayers in the community. To ensure meaningful connections and conversations, build your personal user profile to showcase your land, interests, services, Interest accrues at the rate of 2 percent per month or partial month, up to a maximum of 18 percent per year.  Unpaid property taxes deprive local government of revenue required to fund essential public services like schools, police and emergency response. Townhomes for Sale Near Me; Benton Heights Real Estate; Benton Real Estate; Saint Joseph Real Estate; Data Source: U.S. Census Bureau; American Community Survey, 2018 ACS 5-Year Estimates. View thousands of active listings from across the U.S. Browse farms, ranches, timberland, hunting land, and other properties by location, size, and price. WebSold: 6 beds, 3 baths, 2576 sq.